The DeFi space is clearly at an interesting point.

On the one hand, DeFi tokens lost up to 95% of their value during the current market cooldown, NFTs and Metaverse have taken the spotlight and DeFi 2.0 lost its initial momentum. There were also a lot of exploits, regulatory uncertainties, an unprecedented cult of individuals and some questionable hires.

On the other hand, established protocols have been working like a charm supporting a lot of day to day operations. DeFi on Layer 2 is just getting started. Multichain DeFi and DeFi on other chains are also going through a rapid growth phase.

With all of these, is it possible that the worst is behind us and we are at the brink of a DeFi Renaissance? You’ll find answers to this question and more in this article.

Past

Since the beginning of 2021, the market hasn’t been kind to DeFi.

Despite the amazing innovations and growing total value locked across DeFi protocols the prices of DeFi tokens didn’t reflect this.

Even when the DeFi tokens appreciated in value, together with the overall market, in most cases they still underperformed ETH.

The attention was focused on other things: NFTs, memecoins, Metaverse, alternative L1s – and NFTs again.

DeFi 2.0 brought a bit of hope but eventually resulted in a market overexuberance and a painful price correction.

Ethereum Layer 2 scaling didn’t arrive as quickly as most people expected which created a great opportunity for other chains. The ease of deploying to other EVM-compatible layer 1s resulted in the creation of a multitude of forks of well-known DeFi protocols such as Uniswap or Aave.

Olympus became probably the most forked protocol of them all, fuelling seemingly never-ending ponzi-games across all possible EVM-compatible chains.

The unprecedented cult of individuals didn’t help either. Maybe, just maybe, in the space where anonymously written pieces of code can process billions of dollars worth of transactions, we shouldn’t pay so much attention to individuals and focus on what is really important: code and communities.

It’s been shown time and time again that a cult of an individual can disperse as quickly as it can rise.

There were also a lot of discussions around morality in DeFi. Should a convicted criminal involved in fraud be allowed to anonymously work on a protocol without other people knowing about it?

This question might not be as easy to answer as we may think. For some people, especially those coming from traditional finance that would be something unacceptable. For others, being a good contributor to the ecosystem is what matters and they believe that people should be allowed to recuperate.

One thing is clear, no one working on a DeFi protocol should be able to single-handedly access people’s money – no matter who they are.

The past hasn’t been great on the hacks and exploits side either. Poly Network, Compound, Cream Finance, Badger to name just a few.

Rug pulls haven’t slowed down either with hundreds of forks created for the sole purpose of stealing money from the users.

The Wormhole bug alone resulted in a $326m loss that was fortunately covered by one of the biggest participants in the Solana ecosystem – Jump.

The overall hacks and exploits from the beginning of 2021 total at roughly $2b.

There were also quite a few very close calls.

A bug in Sushi discovered by DeFi researcher and white hacker Sam Sun could’ve potentially resulted in a humongous loss of up to $350m. Kudos to Sam Sun for disclosing the bug in a professional and timely manner.

Unclear regulations around DeFi and crypto as a whole was another widely discussed topic that resulted in a lot of uncertainty for users, investors and founders.

Countries banning and unbanning crypto, tough laws trying to fit DeFi into the existing financial rules being voted on and much more.

Although regulatory uncertainty is still not totally behind us, other previously mentioned things can be considered as relics of the past and definitely something to learn from.

Now, let’s talk about the current state of DeFi.

Present

According to DeFi Llama, the total value locked in DeFi is hovering at around $215b. This is slightly down from $255b at the end of 2021 but still remains high.

When it comes to decentralized exchanges, the monthly trading volume has been at around $50-60b. This is down from over $100b at the end of 2021.

Despite a few new entrants into the AMM space, Uniswap market share remains extremely high at around 75% of the overall volume.

When it comes to lending, liquidity on Aave across 7 different networks is hovering at around $20b at the time of writing this article. This is down from $31b at the end of 2021 over fewer networks.

Although, on the surface, it may look like DeFi has stagnated for a while. In reality, this can’t be further from the truth.

Major DeFi metrics like total value locked across all DeFi protocols or volume on decentralized exchanges don’t show us the whole picture as they are always correlated to the current market conditions.

We have to look a bit closer under the hood to understand what is being built when no one is watching. And what kind of impact it can have in the future.

Layer 2 scaling is clearly one of the big developments and can dramatically increase the adoption of DeFi by lowering the cost and increasing the speed of transactions.

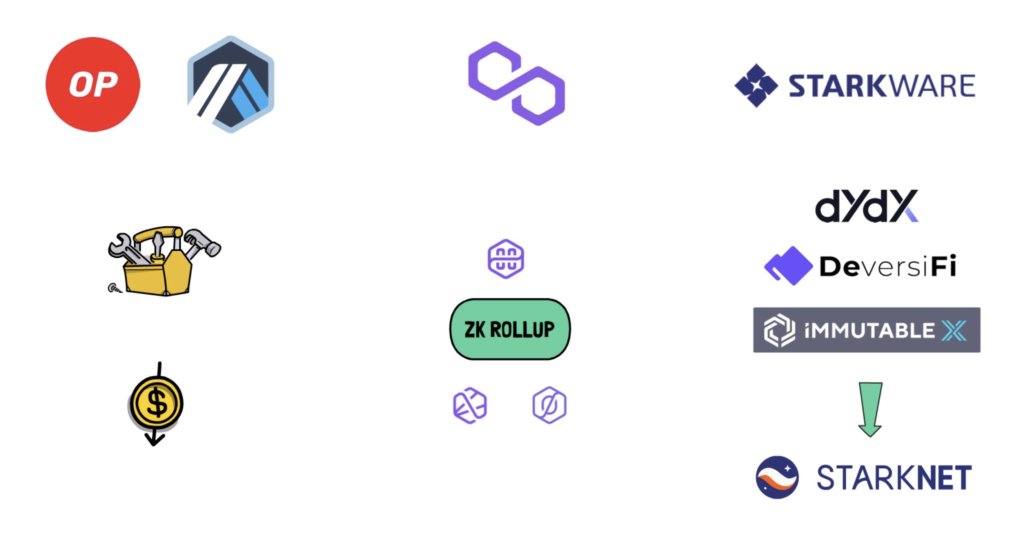

Optimism and Arbitrum are improving their code making them cheaper and cheaper to use.

Polygon has acquired a lot of scaling solutions including ZK rollup tech like Hermez, Nightfall and Maiden.

StarkWare, after successfully scaling single-purpose protocols like DyDx, DeversiFi and Immutable X, is working on a more generalised ZK rollup called StarkNet.

In the meantime, other chains are not slowing down either.

DeFi on Avalanche, Fantom, Solana, Terra and others is also going through a rapid growth phase.

Although at the moment, DeFi protocols on these chains, especially the EVM-compatible ones, are mostly forks of protocols built originally on Ethereum, there are also a lot of new things being tried and built.

Despite some initial criticism, we can see the multichain thesis playing out and coming to fruition.

In the search for yield in DeFi, users are keen to bridge their assets into other chains.

It all looks pretty exciting, but we need to remember that bridges are inherently problematic. Transaction on 2 different chains guarded by different consensus mechanisms cannot be easily executed as 1 atomic operation, so it requires either trusting more centralized bridges or relying on networks of relayers instead of the actual consensus of the 2 chains we are bridging in between.

Bridging to Layer 2 scaling solutions like Optimistic or ZK rollups is a bit more secure as most L2s have escape hatch mechanisms that allow withdrawing funds directly from L1 Ethereum if something goes wrong.

Projects focusing on multichain, like Cosmos and Polkadot, could also be interesting solutions as the bridging transactions are usually secured by 1 consensus mechanism, but it doesn’t solve the problem when jumping between 2 different L1s.

When it comes to DeFi 2.0, despite the market overexuberance, certain mechanisms of this paradigm shift, mostly around incentivising liquidity, may prevail.

Protocols like Tokemak are maintaining a strong TVL of over $1b and introducing new useful features to the overall DeFi ecosystem.

It remains to be seen if other DeFi 2.0 protocols like Olympus will be able to shine again and come back to their original power.

At the moment, the market cap of the Olympus token OHM is essentially backstopped by its underlying protocol-controlled value of the treasury, so to a certain extent, it works as expected in the worst-case scenario.

The more established protocols haven’t rested on their laurels either.

Aave has recently launched version 3 of their protocol that introduces better capital efficiency and improves risk management.

Bancor has also announced version 3 of their protocol that reduces the cost of trading, allows for unlimited deposits and provides instant impermanent loss protection.

Thorchain has recovered from its hack and recently introduced synthetic assets aiming at increasing network usage, network TVL and pool depth. It also allows for cheaper swaps and greater income for liquidity providers.

MakerDAO is discussing a new, aggressive growth strategy that would include things like expanding into more real-world assets.

Sushi is working on Trident – a framework for creating AMMs and Shoyu 2.0 – an NFT marketplace.

Curve, which is fuelling most of stable asset swaps in DeFi, is not slowing down either. Its tokenomics model incentivises a lot of other players to compete for the CRV yield. The process, due to its competitiveness, has been called “Curve Wars”.

The CRV model became so popular that it is being copied by a lot of other protocols in the ecosystem.

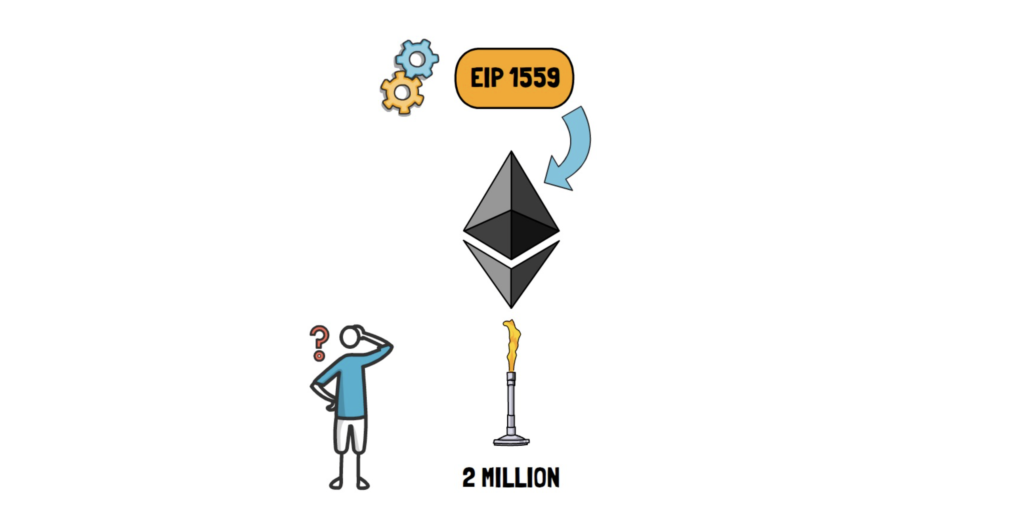

When it comes to Ethereum itself, EIP1559, despite the initial worries, has been working like a charm and burning ETH every day. We have recently crossed 2m of ETH burnt since the change was deployed.

There has also been a big rise in liquid staking. Lido, the dominant player in this category, has over $8.5b of ETH staked. They also support staking on other chains and their Luna staking grew to an astonishing $7.5b.

Rocket Pool, which chose a harder path and decided to start in a more decentralized state, is also showing amazing growth with almost $0.5b of ETH staked.

Although not exactly DeFi per se, NFTs, Metaverse and crypto social media, including the Lens protocol launched by the Aave team, have been a hot topic of discussion.

This can bring more people into the crypto space and allow them to also discover DeFi.

On top of all of this, it’s worth mentioning that even during a market cooldown when users are less prone to invest in new projects, venture capital does not sleep and pours billions of dollars into the DeFi ecosystem and crypto as a whole.

This provides early projects with enough capital to focus on building instead of thinking about how to survive until the next bull market.

As we can see, despite the market downturn, the DeFi ecosystem is flourishing and this won’t stop here – let’s have a quick look into the future.

Future

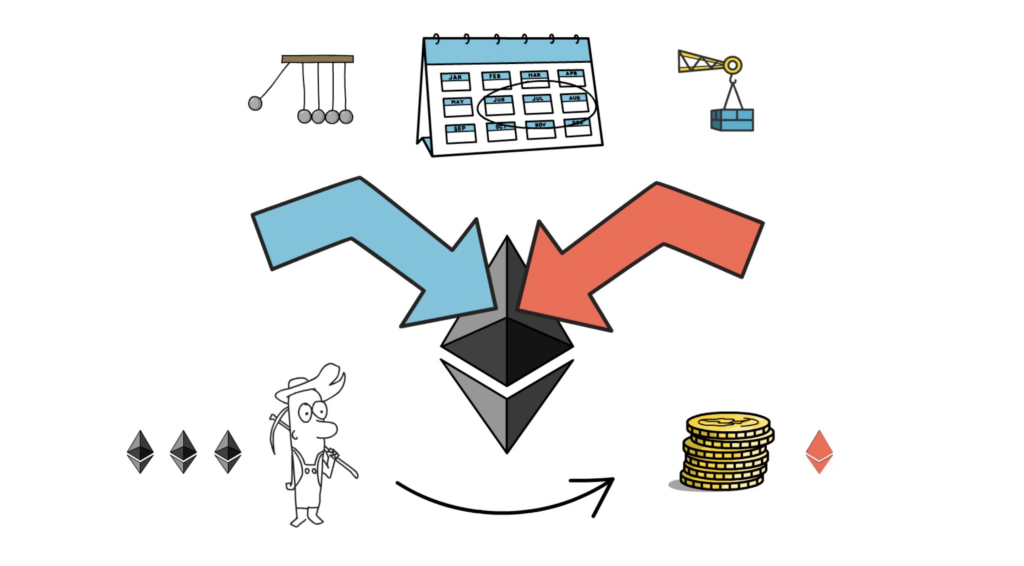

One of the widely discussed events that is coming closer and closer is the Ethereum Merge.

The Merge will transition Ethereum from Proof-Of-Work to Proof-Of-Stake and dramatically reduce the ETH issuance rate which can most likely cause ETH to become deflationary.

The Merge is currently estimated to arrive between June and August this year, but this, of course, depends on further testing. This is one of, if not the biggest changes to the Ethereum protocol, so it cannot be rushed.

The Merge drives one of the current narratives for Ethereum and may result in the next bull market for ETH and DeFi.

There are also a lot of other improvements in Ethereum’s pipeline.

EIP 4488, for example, can drive down transaction costs for rollups by lowering the gas cost of calldata.

L2s are another catalyst that can result in users rediscovering DeFi.

Not only will DeFi be cheaper and faster than ever, it will also enable new DeFi protocols that were previously not possible to implement on Ethereum itself.

Most L2s also have a secret weapon. They can always launch a token and quickly incentivise growth. I wouldn’t be surprised to see some inflection points that will cause all major L2s to launch tokens one by one in a very short period of time.

There are a lot of teams working on L2 scaling, but one of the highly anticipated events is the full launch of StarkNet which will provide a general-purpose ZK rollup.

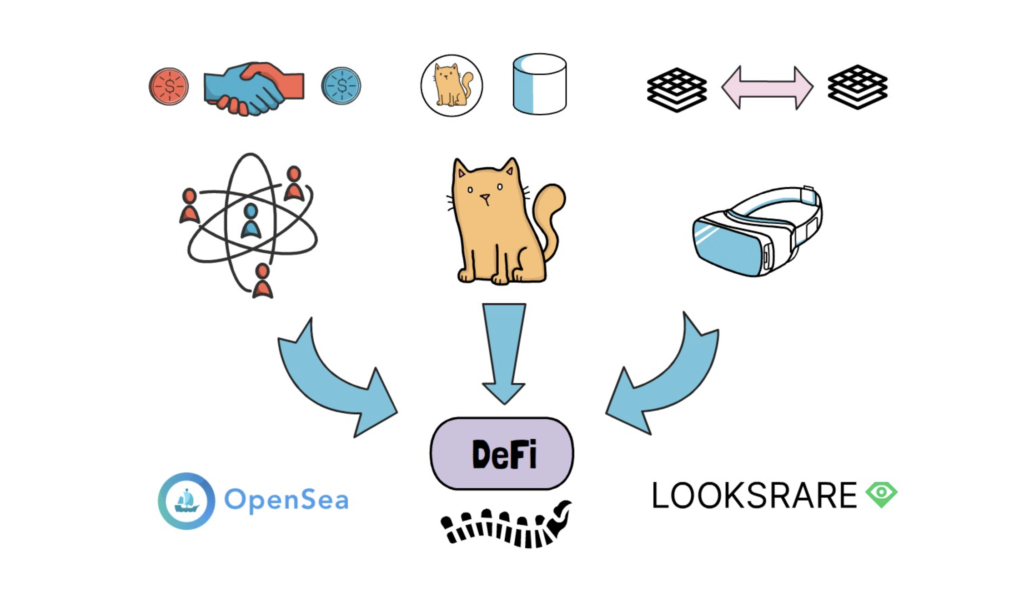

NFTs, Metaverse and DAOs can also fuel DeFi, which could become the backbone of these nascent ecosystems.

Tokenising NFTs and trading them on an AMM – This is DeFi.

Creating escrow contracts to exchange tokens between DAOs – DeFi.

Trading parcels of land in the Metaverse? – Also, DeFi.

Even NFT marketplaces can be considered as decentralized finance.

Another segment of the DeFi market that may experience rapid growth are indexes.

In traditional finance, indexes, such as S&P500 and FTSE100, went through a huge cycle of growth and became a huge part of the overall market. This hasn’t been fully leveraged in DeFi yet.

I wouldn’t be surprised to see more and more focus on indexes in DeFi, especially since the nature of smart contracts allows for easily creating a wide range of indexes, from DeFi blue chips to Metaverse, to NFTs. It also allows for automating rebalances of these indexes.

Index Coop with its DeFi, Metaverse and other indexes is one of the prominent projects in this category.

One thing that we need sooner rather than later is clarification around laws and taxes in DeFi. The current unclear rules stifle innovation and create an adversarial environment for DeFi founders and users.

We cannot allow this space to become a bedrock for financial surveillance and unfair treatment so common in traditional finance.

In the end, I believe that most liquidity will move on-chain and DeFi will attract most banks, hedge funds, other financial companies and maybe even whole countries.

Although there will be a long tail of chains each with a functioning DeFi ecosystem, naturally, the liquidity will concentrate around a handful of chains.

When it comes to the market, it’s hard to say what will happen to the price short to medium term, but I wouldn’t be surprised to see DeFi tokens having another resurgence when the world wakes up to what is being built here.

Summary

The Decentralized Finance space, despite the current market cooldown, keeps evolving with astonishing speed. When the attention moves away from prices, the long-term builders keep delivering value and keep coming up with fresh ideas that later fertilise the next market cycle.

During these seemingly quiet periods, it’s extremely important to stay up to date with the latest trends to benefit the most when the attention eventually comes back to DeFi.

Fortunately, whether it’s MEV, Bridges or something we haven’t yet discovered, Finematics will be here, covering all of these interesting topics in future videos and articles.

So what do you think about the current state of DeFi? What are some of your predictions for 2022 and beyond?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.