Intro

What is Ampleforth? How does it work under the hood and why do the number of my AMPL tokens keep changing every day? You’ll find answers to these questions in this article.

What is Ampleforth?

Okay, so what is Ampleforth all about?

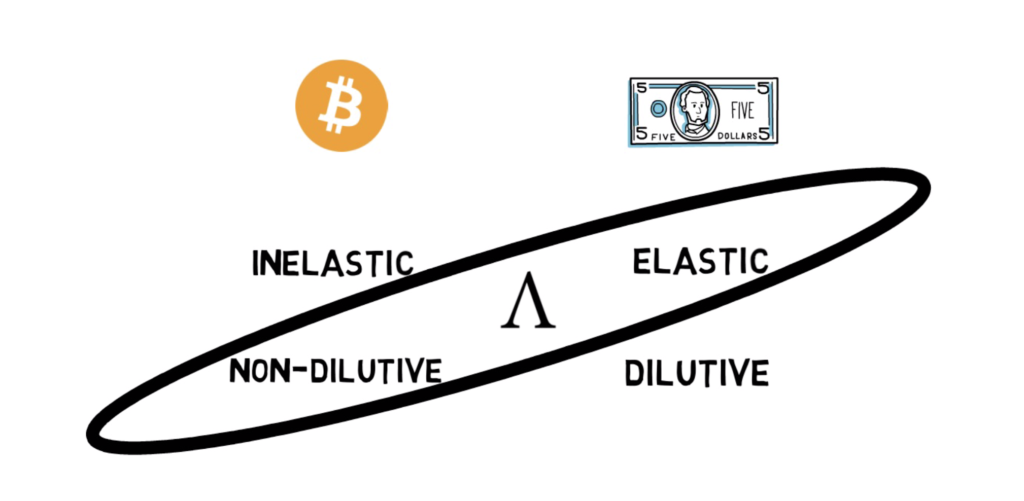

Ampleforth, in essence, is a new cryptocurrency with a quite unique feature – its supply is elastic and can change every day while the ownership of the AMPL tokens is never diluted. Let’s explain what this actually means.

When it comes to money, having an elastic supply allows for printing new money or removing money from the circulation depending on the demand. Fiat currencies such as the US Dollar are good examples of money with an elastic supply as the FED can decide to print more money if there is more demand for it (they can actually also decide to print it without an increase in demand, but that’s another story).

Bitcoin is quite the opposite, its supply is fixed and the only way to accommodate the increase in demand is for the price to go up. Constant price changes can be quite problematic, especially when it comes to denominating things like services, contracts or debt.

So even though elastic money supply can be quite useful to achieve price stability it comes with a certain problem – dilution.

When the FED increases the supply of dollars by printing new money that money is put into the circulation, diluting everyone else’s proportion of the total supply of dollars basically making them poorer. Ampleforth is non-dilutive. This is achieved by applying supply adjustments proportionally across everyone’s balances.

Imagine the following situation: let’s say the FED prints an extra 5% of the total supply of US dollars to meet an increase in demand. This extra 5% would be proportionally distributed across all the accounts holding USD, so if you had $1000 in your bank account, after the supply change you would end up with $1050. That scenario would make the US Dollar non-dilutive as your proportion of the overall supply of dollars would remain the same after the adjustment.

So to summarise this part. Bitcoin is inelastic and non-dilutive. Fiat money such as USD is elastic but dilutive. Ampleforth is both elastic and non-dilutive, so even though the number of your AMPL tokens can change automatically, you’ll always own the same proportion of the overall supply.

By having this unique feature, Ampleforth tries to solve the following problems:

Inelasticity Problem. Fixed-supply cryptocurrencies are vulnerable to sudden shocks in demand that make denominating things harder.

Diversification Problem. Today’s cryptocurrencies are tightly correlated. AMPL’s unique incentives, in theory, allow it to decouple from Bitcoin’s price pattern.

Let’s see how this unique feature of Ampleforth can be achieved.

How does it work?

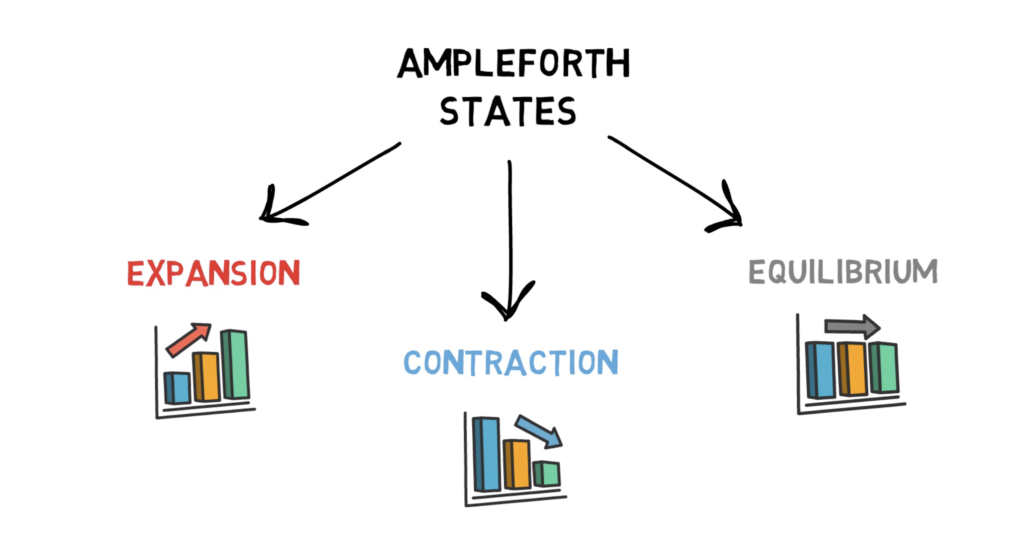

There are 3 states that the Ampleforth protocol can be in, these are expansion, contraction or equilibrium. Before we explain how they work let’s introduce one more concept – price oracles.

Price oracles are used to provide external prices to smart contracts. There are two main functions of price oracles in Ampleforth. The first one is to provide a current exchange rate of AMPL/USD. The second one is to provide a Consumer Price Index value. The CPI is used to establish a “target price” which is a price of 1 AMPL that the Ampleforth protocol tries to aim for. The target price is currently at $1.009 and it represents the 2019 purchasing power of the US dollar as represented by CPI. The target price plays a very important part of the protocol as it is used in conjunction with the current price to determine if there should be a change in the total supply of AMPL.

Now, let’s get back to the Ampleforth states.

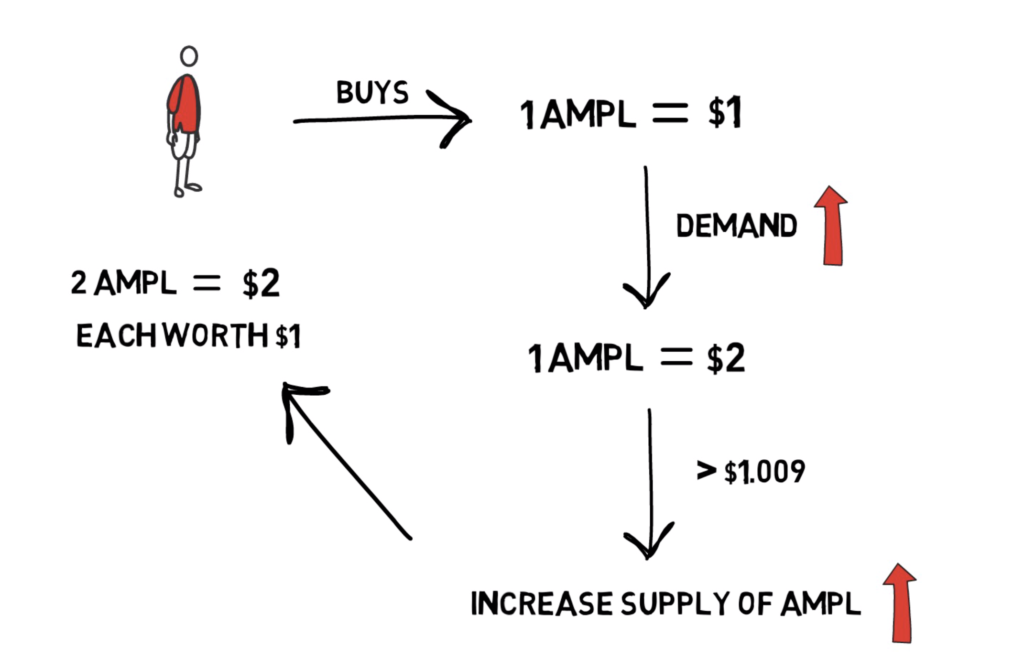

Expansion. In this state, the supply of AMPL tokens is proportionally increased across all the wallets holding AMPL tokens. Let’s go through a quick example.

Imagine Alice buys 1 AMPL for $1. As demand for AMPL suddenly increases, 1 AMPL is now worth $2 which is above our target price of $1.009. In this case, the Ampleforth protocol will seek a price-supply equilibrium by increasing the supply of AMPL, so Alice ends up with 2 AMPL each worth $1.

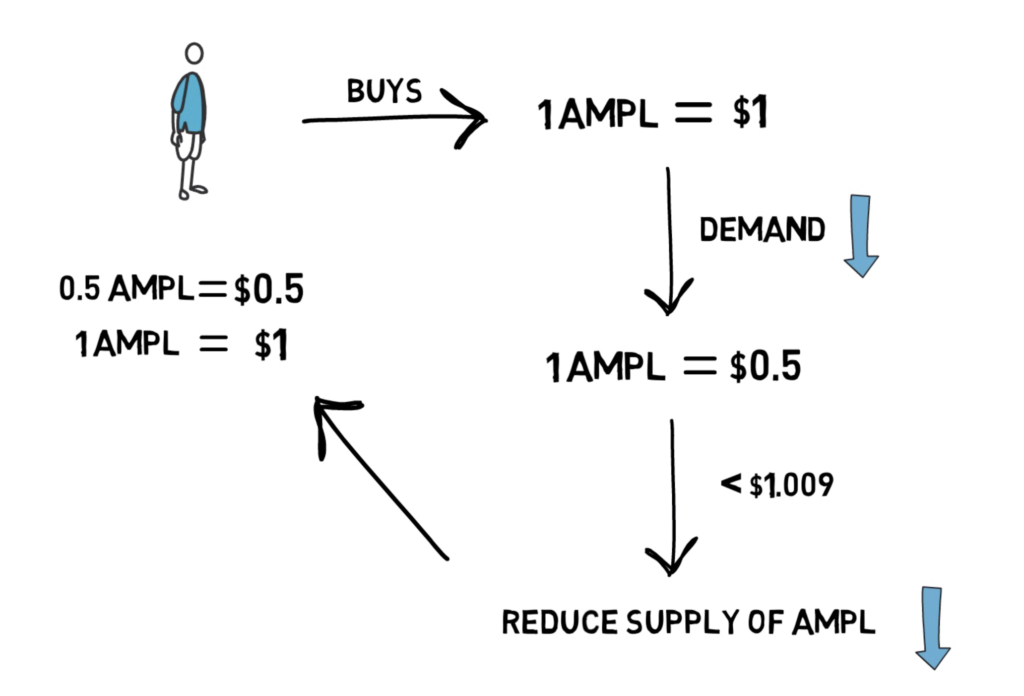

Contraction. As expected, this is the exact opposite of the expansion state. When the system is in the contraction state the supply of AMPL tokens is proportionally decreased across all the wallets holding AMPL tokens.

So if Alice buys 1 AMPL for $1 and due to a decrease in demand, the price of AMPL drops to $0.5, the system will reduce the supply of AMPL. Alice ends up with 0.5 AMPL worth $0.5 as the price of 1 AMPL reverts back to $1.

One important thing to add here is that the algorithm can only affect the supply of AMPL. It cannot, of course, dictate the price directly. It’s up to external players to notice the supply change and this should, in theory, drive the price in the correct direction.

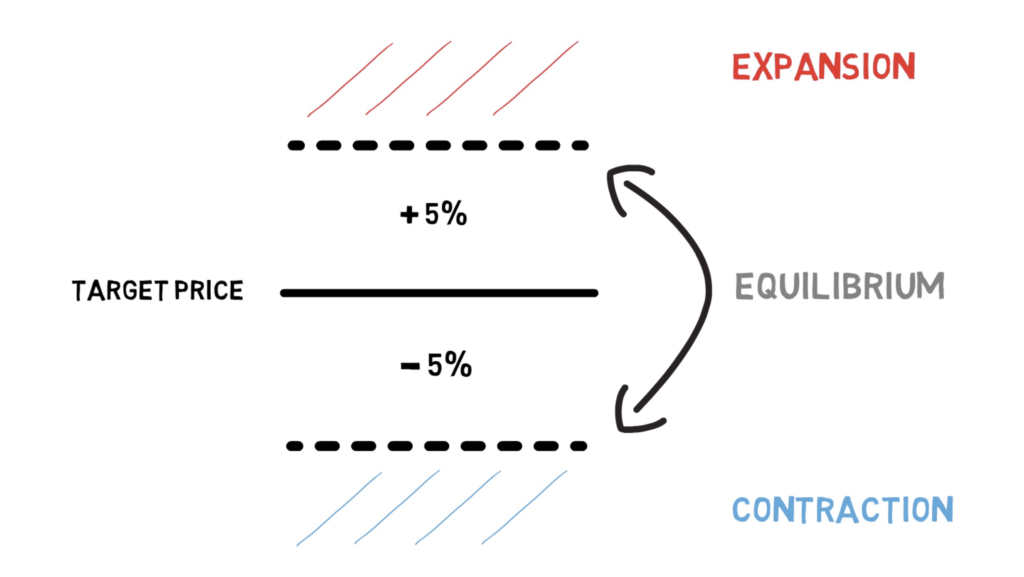

The last state which is equilibrium is the only state where the algorithm doesn’t seek to increase or decrease the supply of AMPL. This is basically a state where there is no need to do anything as the current price is within range of the target price.

Expansion and contraction are achieved automatically by a rebase function in the protocol. Every day at approximately 2 AM UTC time the rebase function can be called. The function makes use of price oracles to get the target price and the current price of AMPL or to be precise a 24h volume-weighted average price. If the current price of AMPL is within 5% of the target price the algorithm classifies the state as equilibrium and doesn’t change the supply of AMPL. If the current price is above the target price + 5%*target price the supply expands and if the current price is below the target price – 5%*target price the supply contracts.

As an example, if the current price of AMPL is $1.10 and the price target is $1.009 the system is in the expansion state as $1.009+$1.009*5%=1.05945, and $1.10 is higher than the max price that can still qualify as equilibrium.

The percentage that is used in the rebase function is also called the equilibrium threshold and it’s one of the 2 main parameters in the Ampleforth protocol. The second parameter represents a smoothing factor also called a dampening factor.

The dampening factor is used to avoid sharp supply changes. Currently, the protocol spreads the supply change over a period of 10 days. This means that if, for example, the rebase function results in a 50% expansion that 50% would be spread over 10 days, so it would result in a 5% supply increase on the day when the rebase function is called.

The rebase function is executed no more than once every 24 hours. This operation is also stateless, meaning that the protocol has no memory of the previous day’s supply change, so it has to recompute the potential supply change every day based on the latest information.

Technology behind Ampleforth

The Ampleforth protocol is implemented as a set of smart contracts deployed to the Ethereum blockchain. The AMPL token implements the ERC-20 interface and can be easily exchanged on decentralized exchanges such as Uniswap.

According to the documentation, the protocol is chain-agnostic and AMPL tokens can exist simultaneously on multiple platforms, so there is also a chance of seeing AMPL tokens on other blockchains in the future.

Use cases

Ampleforth, in the short term, aims at diversifying cryptocurrency portfolios by being less correlated to the price of Bitcoin compared to other cryptocurrencies. In the medium term, it aims at being used as collateral in DeFi protocols. The long term goal for Ampleforth is to create an alternative to central-bank money that is adaptable to shocks.

Summary

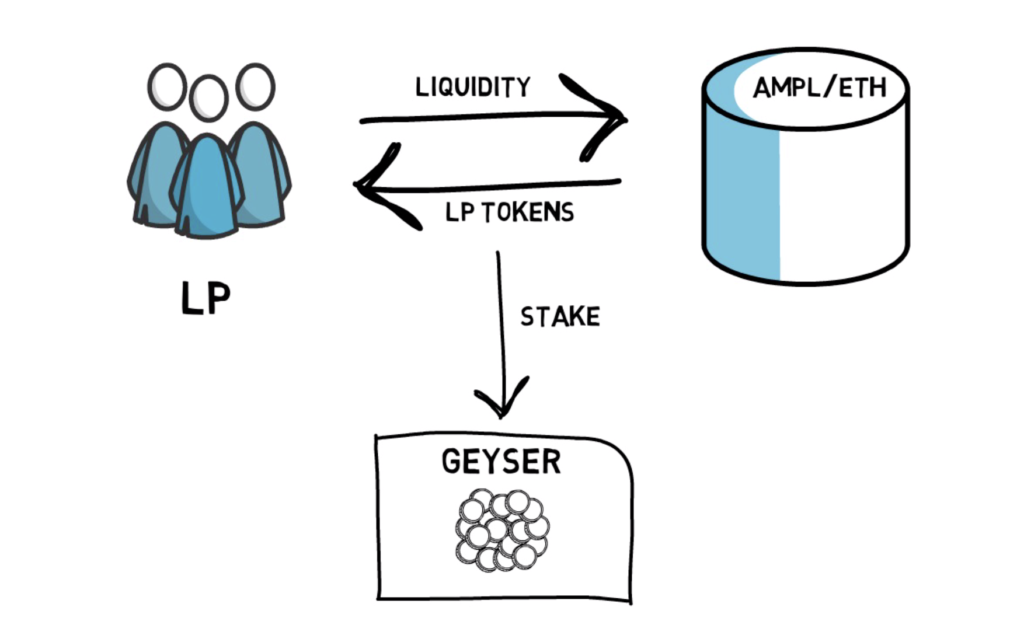

To incentivise more on-chain liquidity, Ampleforth created an incentive program called Geyser where the liquidity providers of the Uniswap AMPL/ETH pool can stake their LP tokens on Geyser and be rewarded with extra AMPL tokens. If you’re not sure what it all means you can check out my article on liquidity pools and a link to the Ampleforth Geyser website.

When it comes to the AMPL tokens the main thing to remember is to always look at the number of tokens in addition to the price to see the full picture of your portfolio.

Ampleforth is clearly one of the most interesting projects in the cryptocurrency space right now, but we have to remember that it is still pretty much a monetary experiment that may or may not work.

So what do you think about Ampleforth? Do you think it has a chance to be used as the money of the future?

If you enjoyed this article you can check out my other articles on decentralized finance and subscribe to Finematics on Youtube.