Intro

Yield Farming is now one of the hottest topics in decentralized finance and there is a high chance you may have already heard something about insane returns that some of the yield farmers are making. So what is yield farming? How did it all start? What are some of the examples of yield farming? And also what are the risks involved? We’ll be going through all of this in this article.

But before we start, if you’re new to DeFi you may want to read my introduction to decentralized finance article first.

Yield Farming

Okay, so what is yield farming actually all about?

Yield Farming, in essence, is a way of trying to maximise a rate of return on capital by leveraging different DeFi protocols.

Yield farmers try to chase the highest yield by switching between multiple different strategies. The most profitable strategies usually involve at least a few DeFi protocols like Compound, Curve, Synthetix, Uniswap or Balancer. If the strategy doesn’t work anymore or if there is a better strategy available the yield farmers move their funds around. They may, for example, move the funds between different protocols or they may swap some of their coins to other ones that are currently generating more yield. In our yield farming world, this procedure is sometimes called crop rotation.

To compare it to traditional finance, you can imagine people trying to find the best saving account with the highest APY. APY stands for annualised percentage yield and it’s a common way of comparing rates of return on your money across different products. It’s also a common way of expressing the returns of different yield farming strategies.

Speaking about APY, it’s common to see traditional saving accounts having around 0.1% APY and anything above 3% is pretty much unheard of these days. When it comes to yield farming, the returns can be pretty insane with some of the strategies bringing as much as 100% APY. So how is that possible and where is a catch?

There are 3 main elements that make such returns possible: liquidity mining, leverage and risk. Let’s cover all of them before we jump into some common strategies.

Liquidity Mining

Liquidity mining is a process of distributing tokens to the users of a protocol.

One of the first DeFi projects that introduced liquidity mining was Synthetix that started rewarding users who helped with adding liquidity to the sETH/ETH pool on Uniswap with SNX tokens.

Liquidity mining creates additional incentives for yield farmers as the token rewards are added on top of the yield that is already generated by using a certain protocol. Depending on the protocol, these incentives may be so strong that farmers may actually be willing to lose on their initial capital just to get more rewards in the distributed tokens which makes their overall strategy highly profitable.

A good example of this was the liquidity mining of COMP tokens introduced by Compound that was initially giving higher rewards to the users who were borrowing assets with the highest APY. This incentivised farmers to start borrowing these assets as the value of minted COMP tokens was compensating them for the high borrow rates they had to pay.

COMP liquidity mining got super popular and was pretty much a catalyst for a wider spread of yield farming.

Leverage

Besides liquidity mining, leverage is another element that makes ultra-high returns possible. Leverage is a strategy of using borrowed money to increase the potential return of an investment.

In our yield farming world, farmers can deposit their coins as collateral to one of the lending protocols and borrow other coins. Now they can use the borrowed coins as further collateral and borrow even more coins. By repeating the whole procedure farmers can leverage their initial capital a few times over and start generating even greater returns on their initial capital.

Risks

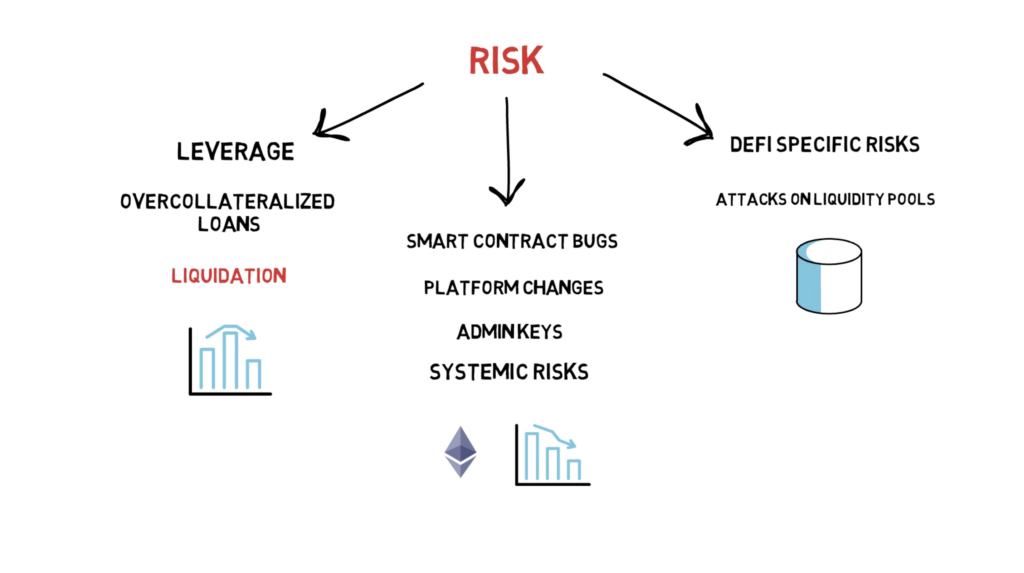

The last missing element of double or triple-digit APYs is the high risk that farmers are willing to take.

The first one is related to the previous thing that we just discussed – leverage. All the loans that farmers are taking are overcollateralized and supplied collateral is susceptible for liquidation if the collateralization ratio drops below a certain threshold.

Besides the liquidation risk, we have our standard smart contract risks like bugs, platform changes, admin keys and systemic risks, for example, Ether sharply losing its value. On top of that, we have a few new attack vectors specific to DeFi, for example, attacks that aim at draining certain liquidity pools.

All of these risks put together are yet another reason why yield farming returns are so lucrative. It’s a high risk, high reward game.

Farming Strategies

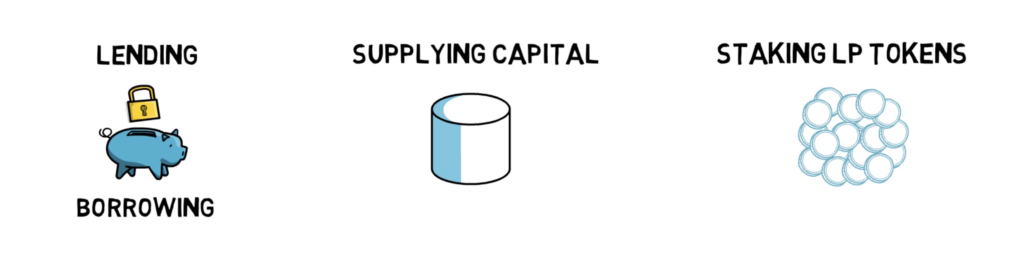

Yield farming strategies are sets of steps that aim at generating a high yield on the capital. These steps usually involve at least one of the following elements: lending, borrowing, supplying capital to liquidity pools or staking LP tokens. Before we look at them one by one, if you already made it this far hit the like button and don’t forget to subscribe to my channel for more DeFi content.

Lending and borrowing. A fairly simple way of getting APY on your capital. Farmers can for example supply stable coins such as DAI or USDC on one of the lending platforms and start getting a return on their capital. Liquidity mining and leverage can supercharge that. For example, farmers can get rewarded with extra COMP tokens for lending and borrowing on Compound. They can also borrow funds with their collateral to buy even more coins. This comes of course with a risk of potential liquidations.

Supplying capital to liquidity pools. Yield farmers can supply coins to one of the liquidity pools in protocols like Uniswap, Balancer or Curve and get rewarded with fees that are charged for swapping different tokens. Again, liquidity mining can supercharge this, so for example by supplying coins to certain liquidity pools, farmers are rewarded with extra tokens. Balancer is a good example of a protocol that rewards liquidity pool suppliers with extra BAL tokens increasing their APY.

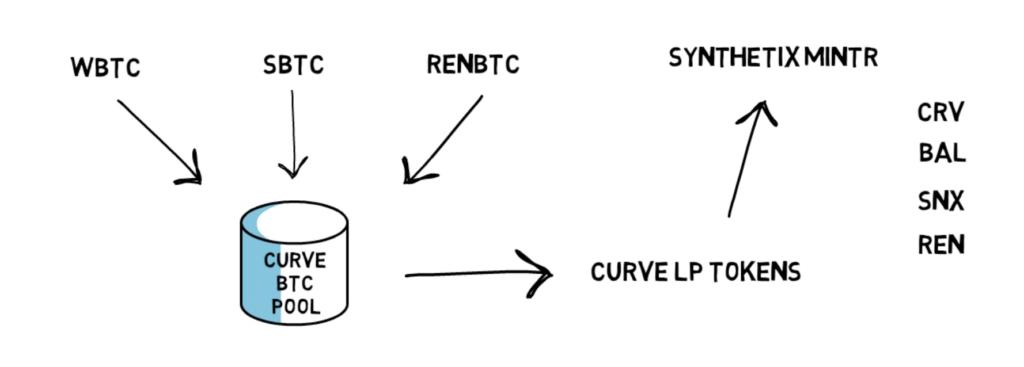

Staking LP tokens. Some protocols incentivise users even further by allowing them to stake their liquidity provider or LP tokens that represent their participation in a liquidity pool. As an example, Synthetix, REN and Curve got into a partnership where users can provide wBTC, sBTC and renBTC to the Curve BTC liquidity pool and receive Curve LP tokens as a reward. These tokens can be staked on Synthetix Mintr where farmers can be further rewarded in CRV, BAL, SNX and REN tokens. Yeah I know that is getting quite complicated and we’ll write another article to explain how liquidity pools actually work.

Some of these strategies can also be combined so yield farmers can maximise their returns even further.

It’s worth keeping in mind that yield farming strategies can become obsolete very quickly by for example protocol or incentive changes and something that may be super profitable right now may not be profitable at all the next day, so it’s important to keep an eye on the running strategies and rotate crops if necessary.

Summary

I hope that now you know a little bit more about yield farming.

It’s worth remembering that yield farming is a completely new thing and it’s far from being a fully efficient market, so there is plenty of opportunities that can bring a substantially better return on our capital than what we can find in traditional finance or even centralized crypto finance. This comes of course with certain risks, some of them we may not even be aware of yet.

Although yield farming has a good potential for increasing user adoption and attracting more people to use DeFi protocols it can also make life harder for normal users who may not be interested in yield farming. For example, users may see borrow rates on Compound changing dramatically and they may not be aware of all the intricacies of different COMP token distribution strategies.

As yield farming can get quite complicated, there are some tools that facilitate calculating how profitable different strategies are, I’ll put some links in the description box below.

So what are some of your favourite yield farming strategies? And what kind of topic would you like to hear about next? Comment down below.

If you like this article don’t forget to subscribe to Finematics Youtube channel.