So Bitcoin on Ethereum – a good or a bad idea? What are the use cases for moving your precious BTC to Ethereum? What are the risks? And what are the protocols that make all of this possible? You’ll find answers to these questions in this article.

Why

Okay, so let’s start with why someone would want to move their Bitcoin to Ethereum in the first place?

The short answer is decentralized finance. Let’s try to understand why this is the case.

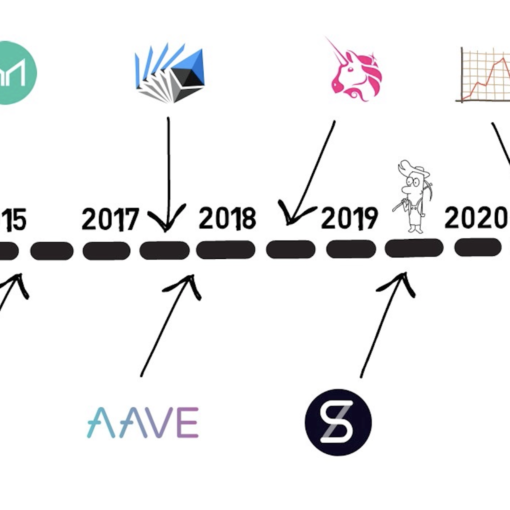

DeFi took the whole crypto space by storm, showing that payments is not the only area of finance that can be decentralized. In fact, DeFi focuses on rebuilding all financial services in a completely decentralized, open and permissionless way. On top of that, it allows for creating financial applications that were previously just impossible to make.

Ether and other tokens that are native to the Ethereum blockchain (ERC-20) can take full advantage of this amazing new space. These tokens can be used as collateral in the lending protocols such as Compound or Aave. They can also be traded in a completely permissionless way on Uniswap.

On top of that, these tokens can generate yield. For example, by being lent out or by providing liquidity to a decentralized exchange.

BTC on the Bitcoin network, although very secure, has very limited use cases. You can mainly send your BTC from one address to the other or just hold (hodl) it and wait until it appreciates in value.

When it comes to other financial services, you have to rely on centralized companies. Let’s take lending as an example. If you would like to make a yield on your BTC or use it as collateral to take out a loan you would have to use a centralized company, for example, BlockFi. This means giving up custody of your BTC and having to provide KYC information – not an ideal solution, especially for people who believe in decentralized and permissionless nature of cryptocurrencies.

Not being able to use BTC in DeFi was one of the main driving forces for making BTC available on Ethereum. Using BTC in DeFi also just makes sense. For example, Bitcoin as a fixed-supply store of value asset with established history can be valuable collateral. A user would be able to lock their BTC and borrow against it in a decentralized fashion.

Currently, there are over 140k BTC on Ethereum worth over $2.5B – an astonishing amount – considering there was only around 1k BTC on Ethereum at the beginning of 2020.

Now, let’s see what options are available when it comes to moving BTC to Ethereum.

Wrapped BTC

Wrapped BTC or wBTC is an ERC20 token that is backed 1:1 by the actual Bitcoin. With over 115,000 coins in existence, wBTC is currently the most popular option for moving BTC to Ethereum.

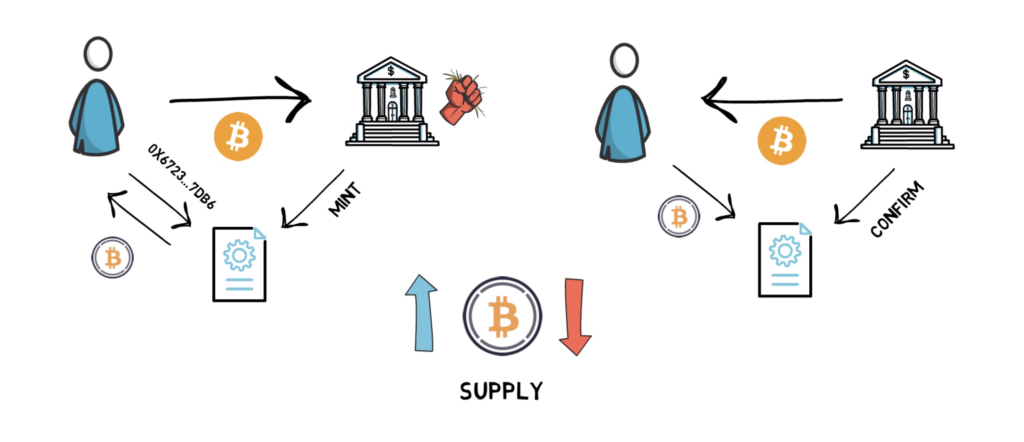

The Wrapped BTC protocol works by allowing merchants to mint and burn wBTC.

If a merchant wants to exchange their BTC to wBTC they initiate the minting procedure by providing an Ethereum address to the wrapped token contract. In the next step, the merchant sends the actual Bitcoin to a custodian. The custodian mints wBTC and it is then sent to the merchant’s Ethereum address.

The original BTC is now held by the custodian and the total supply of wBTC increases by the amount of the BTC provided.

If the merchant decides to redeem their BTC on the Bitcoin network they must request a withdrawal. After the withdrawal process is initiated the merchant burns their wBTC by sending them to the wrapped token contract. The custodian confirms the burn and releases the BTC back to the merchant.

Once the original BTC is withdrawn, the total supply of wBTC decreases by the amount that was burnt.

Merchants are usually companies or protocols that are able to mint and burn wBTC. Other DeFi users can purchase wBTC on multiple exchanges including Uniswap. They can also use services such as wbtc.cafe powered by RenVM to move their BTC to wBTC.

wBTC can be used across multiple DeFi protocols. For example, it can be supplied as collateral on Compound or Aave. Or it can be used to provide liquidity to a 50/50 WBTC/ETH liquidity pool on Uniswap.

This all sounds cool, but as you have probably already noticed there is one major problem here. Wrapped BTC uses a custodian which means it’s centralized.

A good analogy here is a centralized stable coin such as USDC that is backed by USD. Both wBTC and USDC can be extremely useful, as they unlock Bitcoin’s and Dollar’s potential in DeFi. Saying this, I personally don’t believe that this is the end goal. The DeFi community strives for decentralization and we can observe ongoing attempts at bringing multiple external assets to Ethereum and DeFi in a more decentralized way.

This is also a good segue into something a bit more decentralized – RenBTC.

RenBTC

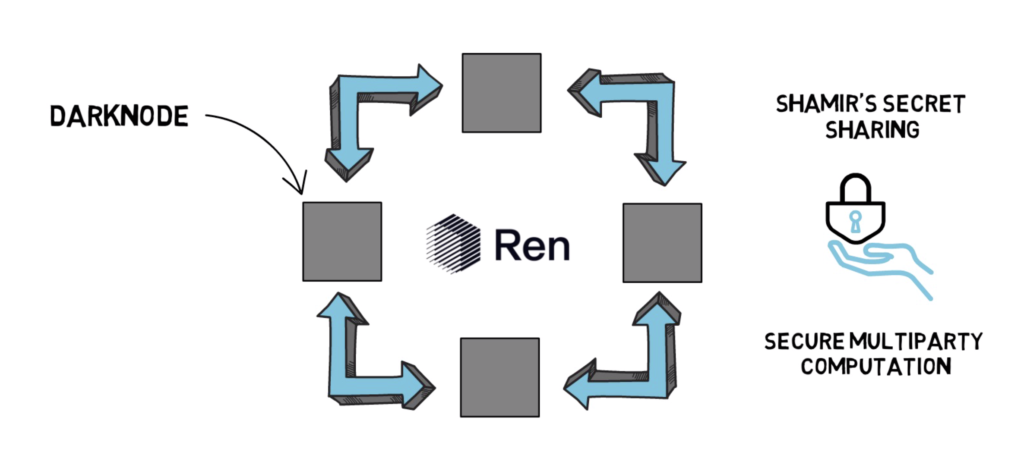

RenVM is an open protocol that allows for bridging assets to Ethereum. It enables the permissionless exchange of value between blockchains. One of the most popular assets to move between blockchains is, of course, Bitcoin. renBTC is Ren’s ERC20 representation of Bitcoin.

Ren, similarly to wBTC, allows for minting renBTC by supplying BTC and redeeming BTC by burning renBTC. Each renBTC is also backed 1:1 by BTC. The main difference is that Ren decentralizes the custody of BTC and makes the process of minting/burning available to everyone – not only the merchants.

Ren protocol runs by operating a network of decentralized nodes called Darknodes. It also leverages a few interesting elements in cryptography such as Shamir’s Secret Sharing and Secure Multiparty Computation.

renBTC is currently the second most popular option with around 17,000 renBTC in existence.

Ren, although aiming to be fully decentralized, is not there just yet. I’d recommend reading a Medium post on RenVM’s road to decentralization that I will link in the description box below.

tBTC

Next one is tBTC. tBTC is the next contender to the title of a go-to protocol for bringing Bitcoin to Ethereum in a decentralized way.

After a bumpy start earlier this year, KEEP – the team behind tBTC – fixed the underlying issues and successfully relaunched the protocol.

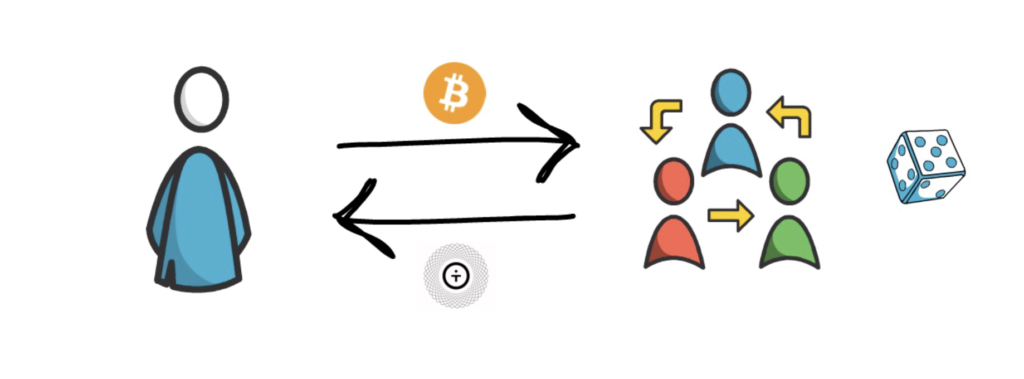

In tBTC, similarily to renBTC, there is no central party taking custody over the locked Bitcoin and also each tBTC is backed 1:1 by BTC.

tBTC allows users with BTC to mint tBTC by using a network of signers. Signers are chosen randomly and a different group of signers is selected for each minted tBTC. The signers have to provide ETH as collateral to ensure they cannot walk away with locked BTC. In fact, they have to overcollateralize their deposit by providing 1.5 BTC worth of ETH. The signers are willing to lock up their ETH as they are rewarded with fees that are paid at the time of redemption.

tBTC is gaining more and more traction – having around 1900 BTC locked in the protocol.

In comparison to renBTC, tBTC uses a different approach to achieve the same goal – decentralized custody of BTC.

sBTC

sBTC is yet another way of making Bitcoin useful in DeFi. sBTC differs from the previous options as in this case there is no underlying Bitcoin at all. sBTC is one of the synthetic assets created by the Synthetix protocol. Synthetic assets or synths track the value of different assets such as S&P500 index, TESLA stock, oil price or Bitcoin.

In Synthetix, all synths are secured by collateral in form of the SNX token. The protocol is highly overcollateralized – currently at 750%. This is mainly to absorb any sharp price changes in synthetic assets.

There is currently around 1,700 sBTC in existence.

sBTC, wBTC, renBTC and tBTC can all trade at slightly different prices, usually at a premium to the actual BTC price. This is mainly because the demand for each of these tokens is different. Also, for all but sBTC, it matters how hard it is to redeem the underlying BTC.

So Is It A Good Idea?

So is it worth moving your precious Bitcoin to one of the mentioned protocols?

It depends. First of all, we have to understand if we have an actual way of benefiting from moving BTC to Ethereum. Maybe we want to use it as collateral in one of the DeFi lending protocols and take a loan based on that collateral.

Or maybe we found an amazing yield farming opportunity. As an example, it was possible to get around 20% APY on providing liquidity to the Uniswap’s wBTC-ETH liquidity pool. Providing liquidity on Uniswap, of course, comes with its own challenges such as impermanent loss. Nevertheless, Uniswap liquidity mining brought a massive amount of BTC to the Ethereum network in form of wBTC.

Even after finding out that we can put BTC into good use in DeFi, there are still other factors to consider. For example, how comfortable we are with decentralization and security assumptions of the protocol that we want to go with. We also have to be aware of potential smart contract or admin key risks, especially in less established DeFi protocols.

Also, even after deciding that we want to move our BTC to Ethereum, we should still consider doing so with only a portion of our total BTC allocation to protect ourselves from unknown unknowns.

It’s also worth mentioning that the actual BTC is never on Ethereum, so it’s a bit of a mental shortcut. When it comes to wBTC, tBTC or renBTC, the BTC is locked on the Bitcoin network and the protocols issue the locked BTC equivalent on the Ethereum network. With sBTC there is no BTC at all – it’s just a purely synthetic asset – a derivative backed by SNX collateral.

It’s also interesting to keep an eye on quite an opposite approach. Instead of bringing BTC to DeFi, some projects focus on bringing DeFi to the Bitcoin network. This, of course, comes with its own challenges and I’ll dedicate a separate article to this topic.

So what do you think about the concept of moving Bitcoin to Ethereum? Would you be willing to do it? If so, what’s your favourite option?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.