Intro

The collapse of FTX is clearly one of the most impactful events in the history of crypto.

So what’s the story behind FTX? How did it rise to power and became one of the biggest crypto exchanges so quickly? What led to its collapse? And what kind of impact will it have on crypto and DeFi? You’ll find answers to these questions and more in this article.

Rise To Power

The story of FTX starts with its founder Sam Bankman-Fried or SBF.

In 2014, SBF graduated from MIT with a degree in physics and started working full time at Jane Street Capital, a well-known proprietary trading firm in traditional finance.

In 2017, after 3 years of trading, Sam decided to quit Jane Street and founded Alameda Research, a quantitative trading company focused on the crypto market.

Interestingly, as a vivid supporter of effective altruism, Sam committed to give away his wealth during his lifetime in the most efficient manner. This could’ve been one of the reasons why he decided to pursue his career in crypto after realising it can create even greater financial opportunities than his work at Jane Street.

The beginnings of Alameda are extremely profitable. Sam, together with his team, noticed a big arbitrage opportunity created by price discrepancies of Bitcoin traded on American and Asian exchanges. The arbitrage allowed the firm to secure early profits and expand its operations into other markets including DeFi.

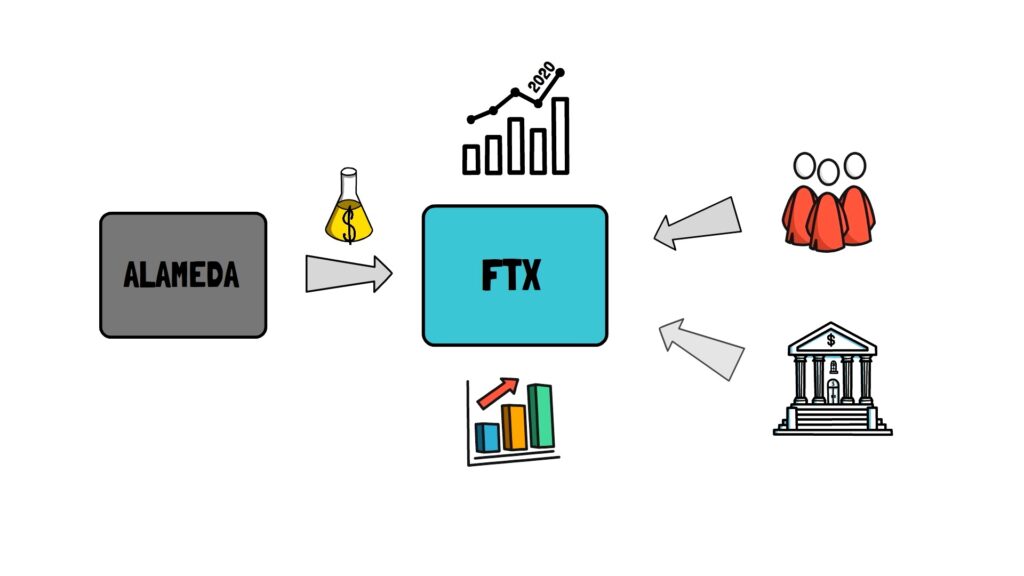

Having a highly profitable trading firm wasn’t enough for Sam. In April 2019 he decided to launch a new crypto exchange – FTX.

This was a challenging task. With hundreds of competitors and top exchanges like Coinbase or Binance already capturing the vast majority of crypto users, it didn’t look like there was enough space for yet another player in the exchange ecosystem.

After a slow start, the FTX volume started growing rapidly in late 2020.

The growth was sped up by having a good market maker, able to supply liquidity to the exchange – none other than Alameda itself.

Liquid derivatives market attracted a lot of sophisticated traders and companies looking to hedge their market exposure.

To fully focus on growing FTX, Sam decided to step down from Alameda making 2 of his close employees Caroline Ellison and Sam Trabucco the co-CEOs.

SBF, seeing the FTX momentum, started heavily investing in marketing: naming rights to the FTX Arena in Miami; ads with Tom Brady and Larry David; influencer marketing amongst popular youtube channels to name just a few.

In the meantime, Sam kept raising money. From June 2021 to the beginning of 2022, FTX raised a whopping $1.8 billion from notable investors such as Sequoia Capital, SoftBank and Tiger Global – building more and more legitimacy.

The valuation of FTX ballooned in size to $32 billion, making SBF, with estimated net worth of $20b, one of the youngest multi-billionaires in the world’s history.

His lifestyle was also something that created a lot of attention.

Vegan, driving a Toyota Corolla, very often sleeping on a bean bag at work and sharing an apartment with multiple other employees. These were not the usual traits of a young billionaire.

By many, including the media, Sam was perceived as a trading and business genius.

Sam’s quick accumulation of wealth and unusual lifestyle started attracting more and more media attention.

With multiple publications from Forbes to Fortune magazine claiming Sam might be the next Warren Buffet or JP Morgan, he quickly became the poster boy of crypto.

Besides heavily investing in marketing, SBF was also active in politics and lobbying. He donated around $40m mostly to the Democratic party and secured a lot of high level meetings with regulators and politicians.

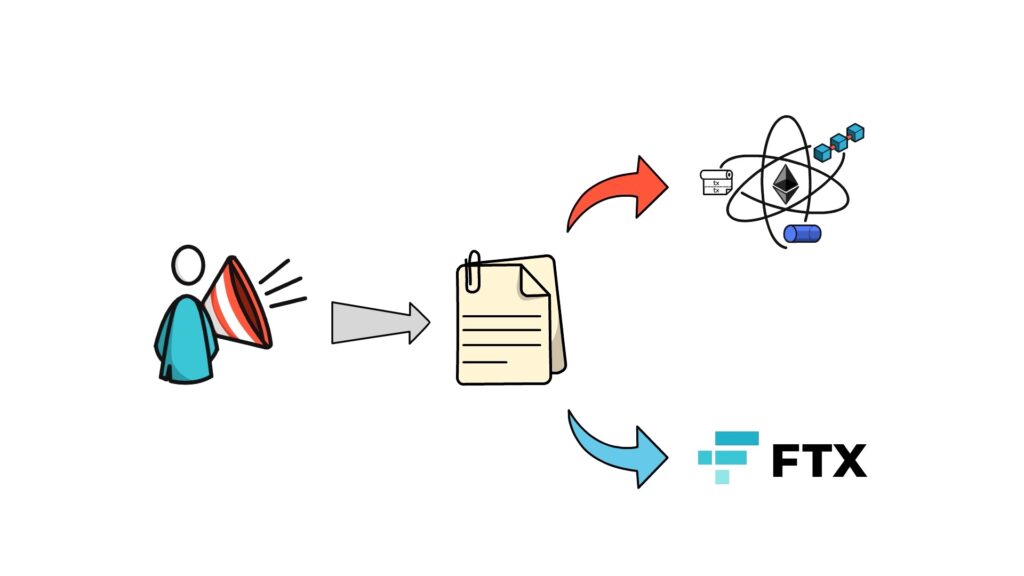

He drew a lot of attention in the crypto space by working on a regulatory framework that would further improve FTX’s position in DC at the detriment of DeFi.

The paper stated that DeFi Frontends should be regulated in a similar fashion to broker dealers in the US.

This didn’t make the DeFi community happy with lots of voices raising concerns about the state of the proposed regulation.

The Collapse

While the conversation around DeFi regulation was still ongoing, another thing started drawing media attention.

A CoinDesk article revealed a leaked balance sheet of Alameda stating that although the company has a lot of funds – most of it comes from just one token – FTT – FTX’s own token, mostly used for lowering trading fees on the exchange.

There was a major problem here. FTT had a very small float which means that only a small portion of the total supply of the token was actively traded. On top of this, the vast majority of coins were held by FTX, Alameda and other associated entities.

The CEO of Alameda, Caroline, quickly clarified that the leaked balance sheet didn’t represent the full picture of Alameda’s books. Regardless of her statement, the crypto market remained sceptical of the situation with a lot of speculation about the potential insolvency of Alameda.

The previous big collapses of Three Arrows Capital and Terra/Luna, meant the market participants were extremely vigilant when it came to any rumours of a potential insolvency.

The next move that directly led to the collapse of FTX was even more surprising.

Besides the well known FTX investors such as Sequoia Capital or Tiger Global from the latest funding rounds, one of the early FTX investors – Binance – remained a bit under the radar.

Binance invested in a strategic early funding round of FTX at the end of 2019.

As FTX started rivalling Binance more and more, the Binance CEO – CZ – decided it was time to exit their FTX investment. Interestingly enough, FTX didn’t decide to pay back the investment in dollars and instead used a combination of stablecoins and their own token FTT. This in turn made Binance one of the biggest holders of the FTT token.

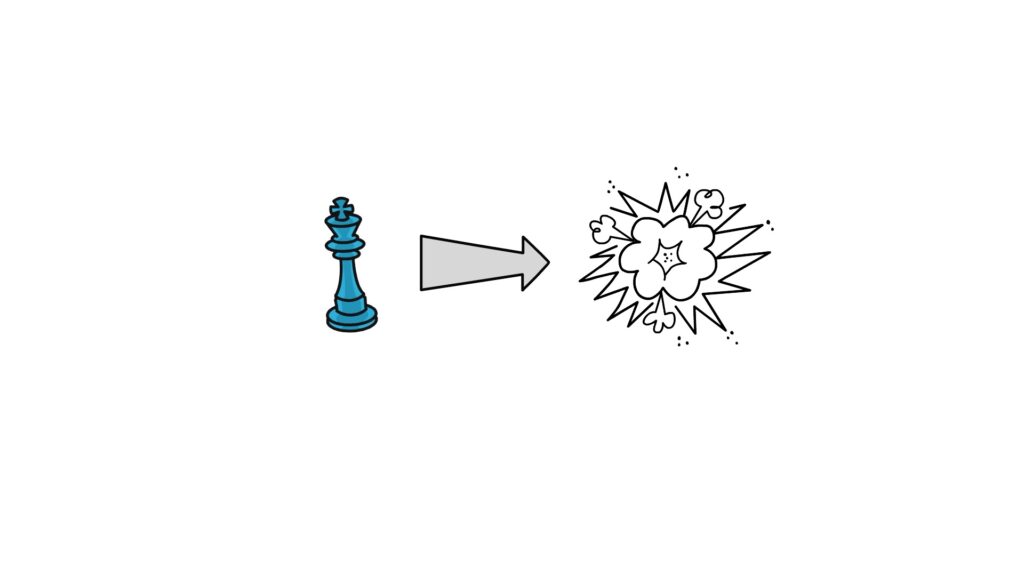

CZ, most likely also worried by the insolvency rumours of Alameda, decided it was time to sell their FTT position.

The move was publicly announced on Twitter by CZ himself – claiming that Binance will try to minimise the market impact of their FTT exit by slowly selling the tokens over time.

This didn’t help already weak FTT price action and further incentivised selling.

The CEO of Alameda stepped in and announced that they were willing to buy all the outstanding FTT tokens at a fixed price of $22.

The situation resulted in SBF tweeting a few perhaps not fully thought through statements that just added fuel to the fire.

Under the hood, it looked like there was a lot of tension between SBF and CZ – most likely driven by aggressive legislation lobbying by FTX that could have been detrimental not only to DeFi but to its competitors like Binance.

In the meantime, spooked market participants accelerated withdrawing their funds from FTX causing a major bank run on the exchange.

The outflow of funds from FTX reached $6b over the span of just 72 hours causing FTX to pause their withdrawals.

There were even more surprises along the way.

Out of nowhere, Sam publicly announced that Binance and FTX signed a non-binding letter of intent stating that Binance is interested in fully acquiring FTX.com after completing a due diligence process.

The statement created a shock wave across the whole crypto industry with all major media outlets reporting on the situation within the next few hours.

A day later however, after taking a closer look into the FTX and Alameda books and seeing a big multi-billion dollar hole, Binance decided to pull out from the offer.

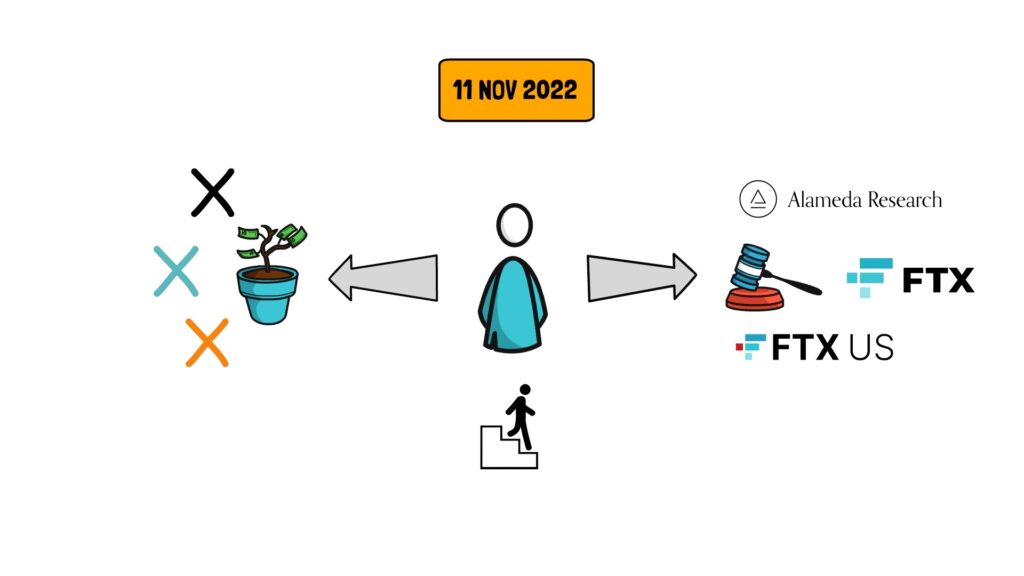

On the 11 of November, Sam, after a few more unsuccessful tries at raising extra capital, decided to finally give up, announced stepping down as the exchange CEO and filed for the Chapter 11 bankruptcy. This would include FTX.com, Alameda and FTX.us that until this moment was still not considered to be affected by the situation.

Chapter 11 included appointing a new CEO, John J. Ray III, who previously led disgraced energy titan Enron through the bankruptcy process.

In the meantime, CZ clarified in a statement to his employees that he hadn’t planned to bring down FTX and that he exposed the hole in their balance sheet by accident.

Regardless of the intent, CZ’s actions will remain one of the most strategic moves in the history of crypto.

After the bankruptcy was announced, a few more important things came into the light.

FTX and Alameda consisted of 134 legal entities, most likely to further obfuscate the flow of funds between the companies.

FTX also didn’t have a board of directors or even a CFO – these were clearly some of the biggest red flags.

We’re still waiting for the full story to unfold, but at the moment it looks like the main hole in the FTX balance sheet was caused by lending funds to Alameda that become insolvent, most likely at some point during the 3AC saga.

It also appears that FTX’s accounting systems had a backdoor where the flow of funds between FTX and Alameda wouldn’t be reported correctly, making it impossible for the auditors and other employees to identify the problem earlier.

To add fuel to the fire, on November 12th, the remaining exchange balances suddenly started dropping. Later that day it became clear that the exchange was being exploited. It remains to be seen if the attack was executed internally or externally.

In retrospect, we can see that raising capital, donating to political parties, heavy marketing and even bailing out other insolvent companies was just a power move by SBF to detract the public from the insolvency of his own company – FTX.

Impact

Besides losing customers’ and investors’ funds, the collapse of FTX is already having a knock-on effect on other companies and the overall crypto market.

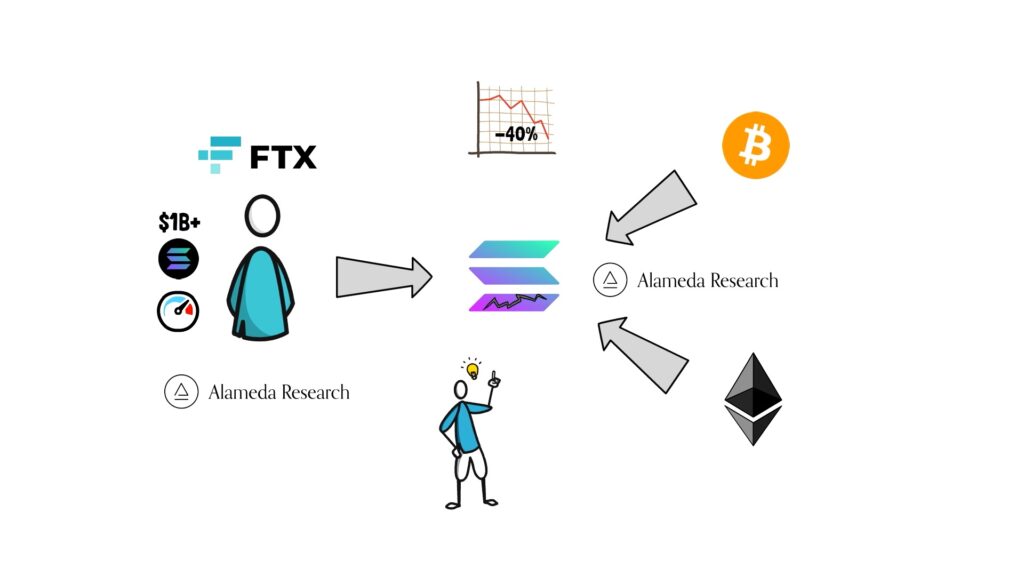

Solana, a layer 1 blockchain, was heavily affected by the collapse of FTX. This was driven by a few main factors.

First of all, FTX, Alameda and SBF were big supporters of the Solana ecosystem, holding over $1b worth of the Solana SOL token.

The market anticipated potential SOL selling pressure which resulted in the price of the coin dropping by over 40% in one single day.

Secondly, wrapped assets on Solana such as bitcoin and ether were backed by Alameda and instantly lost their value causing havoc in the lending markets.

BlockFi was another company heavily affected by the FTX collapse. In July 2022, BlockFi was bailed out by FTX by offering a $400m credit facility. After the FTX collapse the BlockFi team issued a statement that they paused withdrawals.

We can also most likely expect to see more affected companies being revealed in the near future.

Another big impact of the FTX collapse is the loss of trust in the crypto industry, already shaken by Terra and Three Arrows Capital.

Each time a big event like this happens, it unfortunately draws more and more people away from crypto and creates more crypto sceptics.

There is also a worry about potential regulatory implications of the FTX collapse. The regulators might see this event as a good reason to heavily regulate the whole space which might be detrimental to further adoption.

As a result of Alameda going under, the crypto markets are also experiencing a period of low liquidity. Alameda was one of the biggest market makers in both CeFi and DeFi, but outside of that, we can now see other market makers reducing their market exposure by scaling back on their market making activities.

This hopefully should be only for a short period of time until all the information regarding the FTX collapse and its knock-on effects become clear.

The collapse of one of the biggest exchanges will also lead to further centralization of power in the exchange space. The customers’ choice will be limited to a few major players.

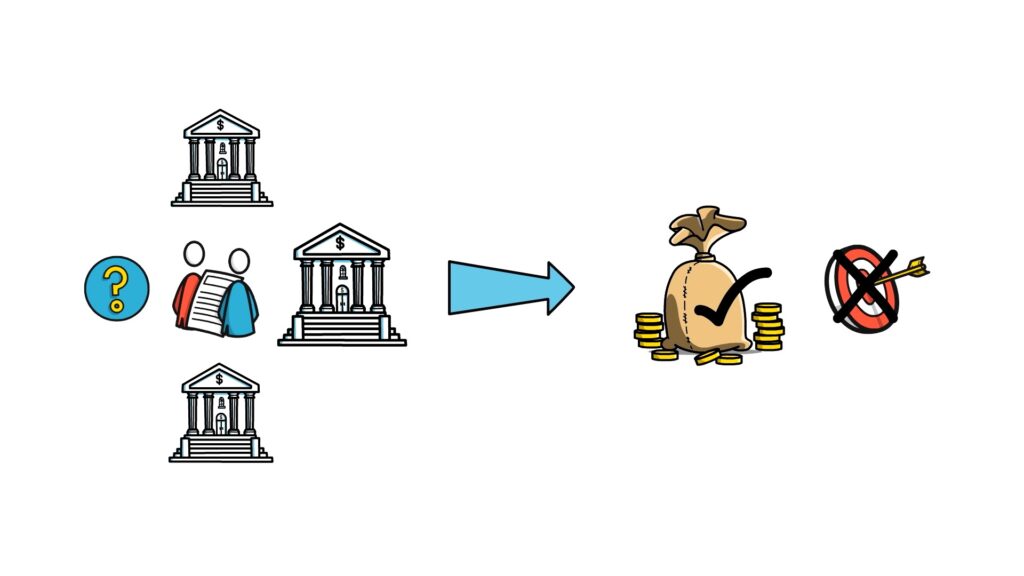

To create more transparency, a lot of exchanges decided to start creating a proof of reserves of their assets. This can help with seeing obvious misconduct but it’s not a golden bullet. Unfortunately, the proof of reserves doesn’t show all the outstanding liabilities, so it cannot be used to create a full picture of the exchange solvency.

The Path Forward

The collapse of FTX further damaged the already shaken reputation of the crypto industry.

At this point it’s worth answering the question. What is the path forward for crypto?

One thing is certain, we surely cannot just assume the lack of other, new bad players within the ecosystem. Some of them might be building their legitimacy for years before taking advantage of their position.

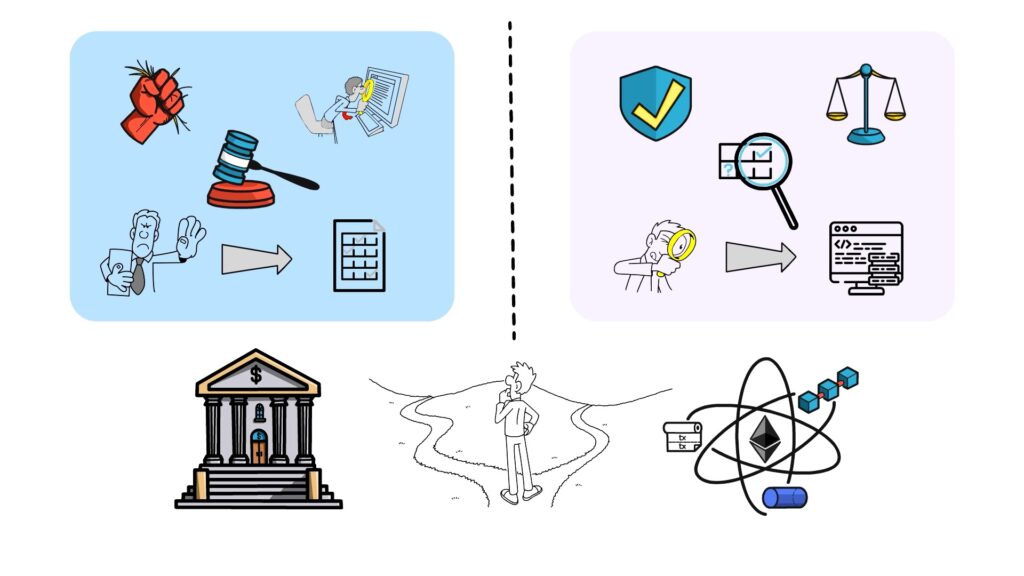

It looks like there are two main paths forward.

One focuses on more regulation, more centralization and more oversight basically recreating power structures known from traditional finance. This path also strengthens arbitrary access to financial services based on your country of origin and financial history.

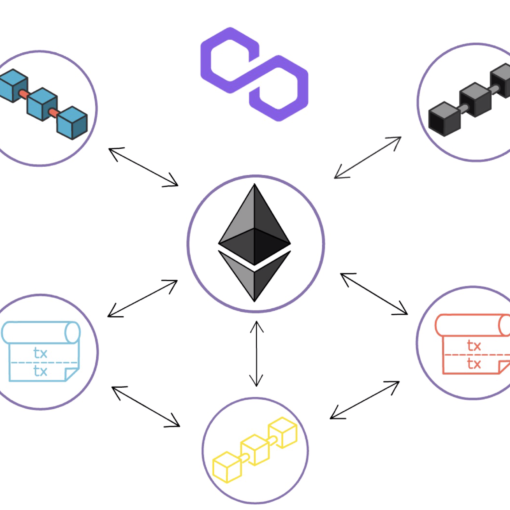

The other path is a bit more interesting and focuses on on-chain transparency, self-custody, fair access and is self-regulated by protocols whose mechanics can be fully understood from the code that can be audited by anyone – this is DeFi.

There is also a possibility these two paths will exist in parallel. Centralised entities that take custody over customers’ funds will be heavily regulated while DeFi, thanks to its transparent and self-custody nature, will remain free and open to anyone.

One thing is clear, DeFi needs to find ways to make it easy for new users to onboard. This includes improving user experience of non-custodial wallets and increasing the security of interacting with DeFi protocols.

It’s also worth emphasising that during the collapse of FTX, Ethereum, DeFi and even the vast majority of other chains worked exactly as expected.

Uniswap, the biggest decentralised exchange in DeFi, has been working flawlessly for over 4 years processing on average more than 1 billion dollars in daily trading volume.

Summary

To summarise this article, it’s important to remember that the crypto industry started with Bitcoin and it was created with the importance of self-custody and transparency in mind.

I want to highlight that a lot of people lost their life savings in the FTX collapse. I wish them all the best when it comes to recovering the funds during the bankruptcy process.

Going forward, we should be sceptical of new leaders who quickly come to power and may even quicker leave in disgrace.

I’d also love to see more people being onboarded to DeFi taking the custody of their own assets into their own hands.

This comes with its own challenges but I believe they can be solved over time.

So what do you think about the collapse of FTX and the future of crypto? Comment down below.

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.