So is Yield Farming dead? Are there any good farming opportunities left? And when are 1000% APYs coming back? We’ll answer all of these questions in this article.

Yield Farming & Liquidity Mining

Before we jump into the main topic, let’s quickly recap what yield farming actually is.

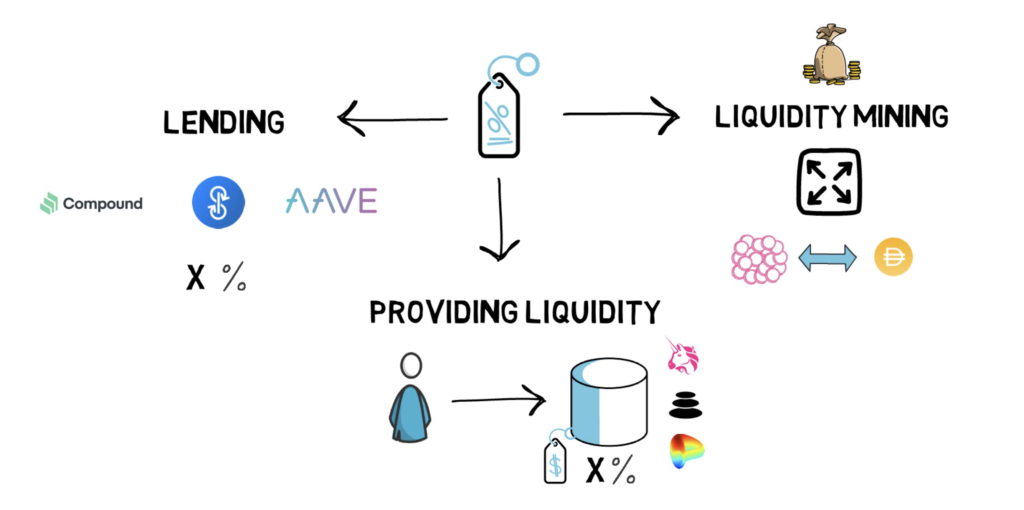

Yield Farming, in essence, is a way of trying to maximise a rate of return on capital by leveraging different DeFi protocols. Yield farmers try to chase the highest yield by switching between multiple different strategies. If the strategy doesn’t work anymore or if there is a better strategy available the yield farmers move their funds around.

Liquidity mining plays a big role in yield farming to such an extent that sometimes these two concepts are used interchangeably. Liquidity mining is a process of distributing extra tokens to the users of a protocol, for example, Compound distributing COMP tokens to lenders and borrowers on their platform or Uniswap distributing UNI tokens to their liquidity providers.

If you haven’t read it yet, I’d recommend reading my other article on Yield Farming to understand these concepts even better.

Where is the yield coming from?

To answer our main questions, we have to first understand where the farming yield is coming from.

There are a few options where the yield can be generated in defi.

The first one is lending. You can lend your coins on platforms such as Compound or Aave and receive usually a single-digit APY on your assets. You can also use Yearn Finance to automate switching between lending protocols with the highest APY.

The next one is providing liquidity to liquidity pools. You can supply your coins to platforms such as Uniswap, Balancer or Curve and start generating extra money by collecting fees on trades going through the pool. This usually also yields a single-digit APY on your assets. You also need to make sure you understand what impermanent loss is.

Now, it’s time for the most lucrative way of generating a yield on your assets in decentralized finance – the previously mentioned liquidity mining.

Liquidity mining is the biggest enabler of high yields in yield farming. This is because the extra tokens that are received can be instantly sold for profit, boosting the APYs.

Let’s take Uniswap’s UNI token liquidity mining program as an example that currently yields 23% in their ETH-DAI liquidity pool. Yield farmers can supply their ETH and DAI to a liquidity pool and start receiving UNI tokens that can be later sold for, let’s say, ETH or a stable coin, greatly improving their APY generated from the liquidity pool fees.

Liquidity mining was previously able to bring crazy high APYs. Even as high as 2500% in Sushi or Yam farming.

So why was that even possible before?

The answer is fairly simple – there was a high demand for the tokens that were being distributed.

To illustrate this, let’s have a look at a quick example.

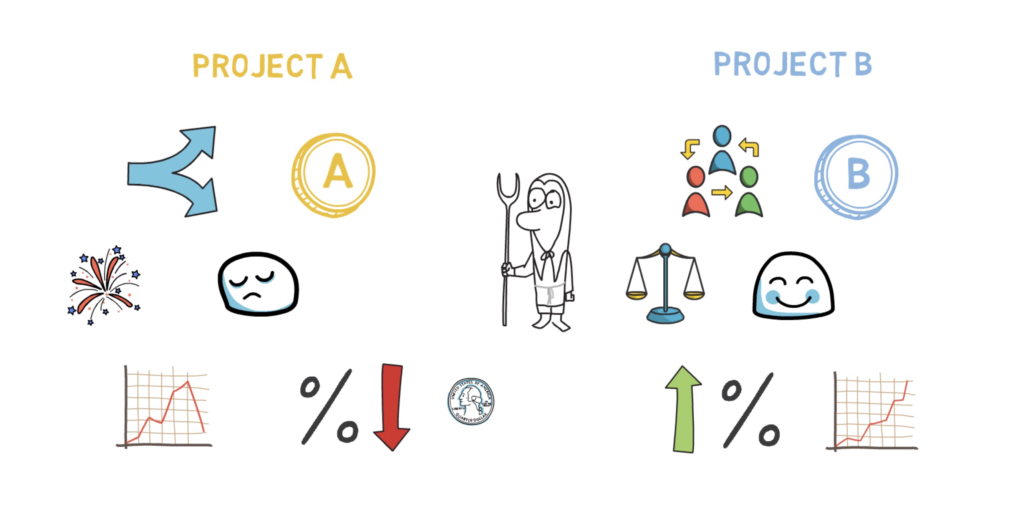

Project A, a fork of another well-known project, creates a new token – token A and distributes it via liquidity mining. After the initial hype, people quickly realise that Project A doesn’t bring much value to the decentralized finance space and start selling their tokens A rapidly.

If this happens the yield on Project A’s liquidity mining program collapses as the farmers can only sell their tokens for a very little amount of money.

Project B, on the other hand, is a well-known project that just started its liquidity mining program by distributing token B. Token B is in demand as investors believe in a long term value proposition of Project B and they think that token B will appreciate in value over time.

In this case, high demand from investors is met with high supply caused by yield farmers selling their token B.

Market Sentiment

On top of the viability of a project, a general market sentiment also plays a huge role. In a down-trending market, the demand for all the tokens decreases. This, of course, means less demand for the tokens that are being distributed by liquidity mining, hence lower APYs.

So if liquidity mining requires a constant flow of new capital, you may ask a question – is this some kind of a ponzi scheme?

Not really, liquidity mining just reacts to the natural supply and demand of the tokens, similarly to the token prices.

Bear Market -> higher supply than demand -> lower prices -> lower yields

Bull Market -> higher demand than supply -> higher prices -> higher yields

On top of that, good projects may be reluctant to even start their liquidity mining programs when the market sentiment is negative, so there are fewer opportunities available. This is kind of similar to companies not doing their IPOs during a recession.

Is Yield Farming Dead

Okay, so let’s answer our main question here – is yield farming dead?

Probably, you already know the answer to this question by now.

No, yield farming is not dead, it just goes through the same cycles as the whole crypto market.

The fact that yield farming is not dead, doesn’t guarantee the craziness of farming food tokens with 1000% APY coming back. In fact, we can see new projects iterating on the concept of liquidity mining and trying to improve different aspects of it.

Most projects that want to distribute their tokens have to find an optimal way of doing so without flooding the market with tokens and causing a constant selling pressure. This is important even in an up-trending market.

One way of reducing the selling pressure is to introduce additional vesting of the newly distributed tokens.

Opportunities Left

So are there any opportunities left in a down-trending market?

Yes, there are still some good projects going through their liquidity mining program. The yield, although not as high as it used to be, can still be much higher than the yield generated by just lending your tokens.

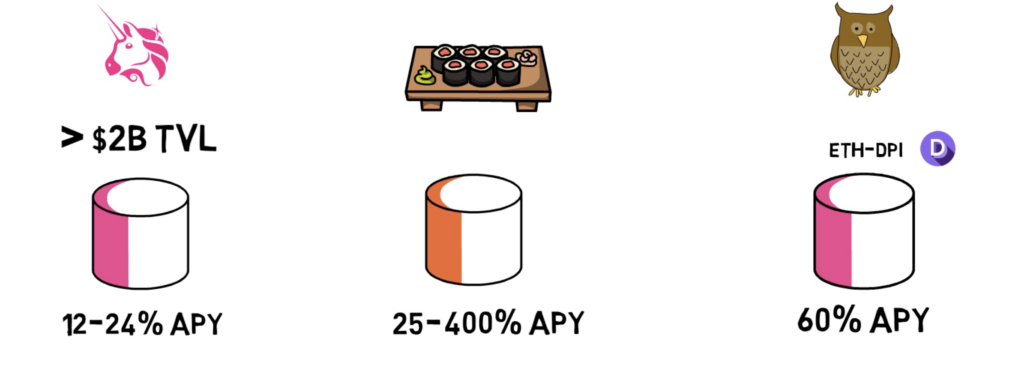

Uniswap’s UNI token liquidity mining program, with over $2B of total value locked, is probably the safest option at the moment.

It offers between 12-24% APY, depending on the liquidity pool.

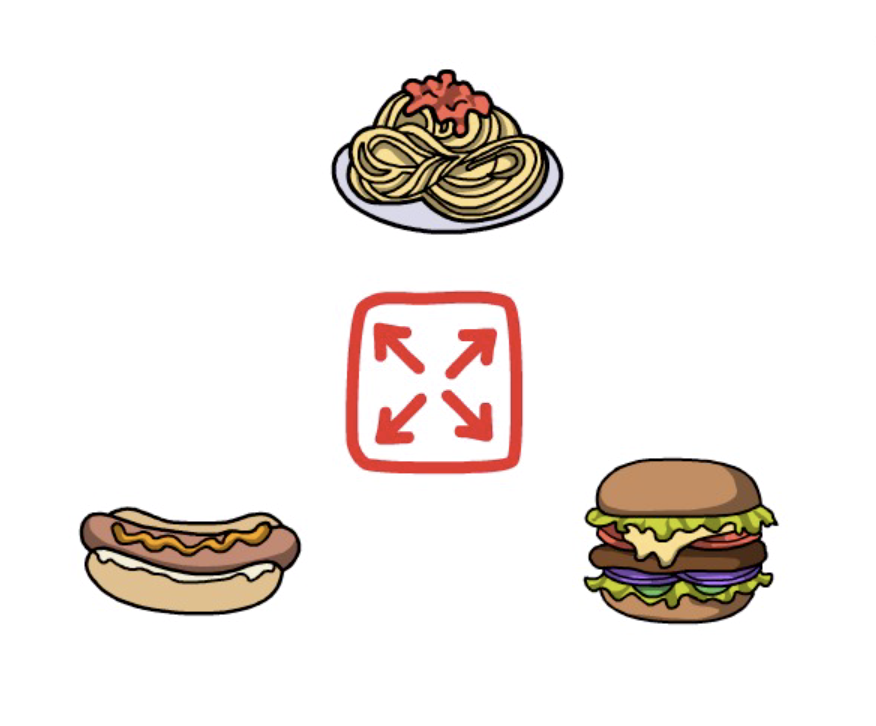

SushiSwap still offers between 25% and as high as 400% APY, depending on the pool.

Index Coop is another interesting example with 60% on ETH-DPI Uniswap LP tokens. DPI is a DeFi Pulse Index that represents 11 top defi tokens, so if you’re bullish on both ETH and DeFi this could be a good option for you.

There is also a lot of other fairly popular, but more risky options such as Pickle, Core or Ampl. In these projects, the highest APY is usually generated by participating in a pool that requires holding their corresponding token, also known as Pool 2. The main risk here is impermanent loss, especially in a down-trending market.

For example, although you can get 168% APY on the PICKLE/ETH pair, you are additionally exposed to the price of PICKLE. If the price of PICKLE starts going down, you’ll lose some your ETH because you are supplying liquidity to the 50/50 PICKLE/ETH Uniswap pool.

There are also some other interesting options available on layer 2 platforms, such as Honeyswap on xDai. In the future, I’d expect to see more and more liquidity mining programs being launched on layer 2 platforms, with the aim of attracting more users from the base Ethereum layer (layer 1).

Of course, before participating in any of these yield farming options make sure you do your own due diligence, including assessing smart contract and admin key risks and making sure to understand the impact of impermanent loss on your supplied liquidity.

So what do you think about the current state of yield farming and its future potential? And what are your favourite liquidity mining programs?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.