Introduction – The YAM Protocol

So what is the story behind YAM, a defi protocol that attracted $600M of capital and ceased to exist in less than 48 hours?

Let’s start with what Yam protocol was all about.

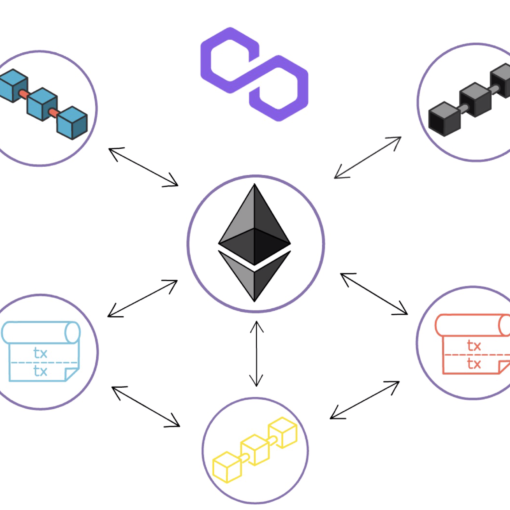

Yam, a protocol built as a monetary experiment, combined some of the most interesting innovations in programmable money and governance, such as an elastic supply, on-chain governance, a governable treasury and a fair distribution mechanism.

YAM, a cryptocurrency of the Yam protocol, was meant to work in a very similar way to Ampleforth, reacting to market conditions by expanding or contracting the supply of YAM targetting 1 USD per YAM. If you need a recap on how this mechanism works under the hood, you can find a detailed explanation in my Amplefoth article.

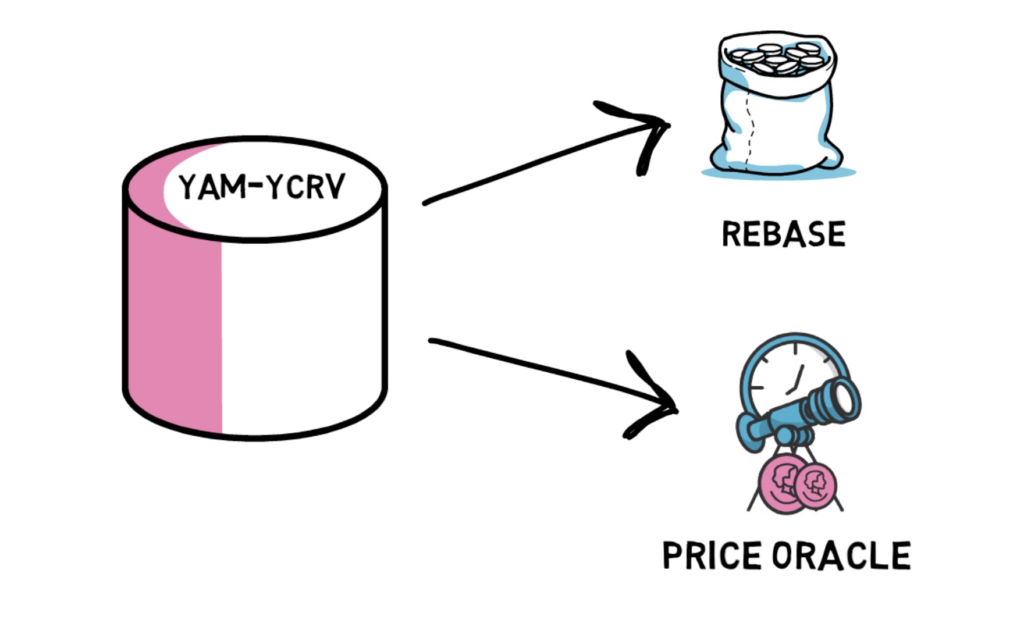

One major difference between Ampleforth and Yam was the fact that Yam was meant to use a portion of each supply expansion to buy yCRV that is a high-yield USD-denominated stable coin. Once bought, yCRV was supposed to be added to the Yam treasury. YAM holders were able to decide how to use these funds for future development and changes to the protocol entirely on-chain through community voting.

Inception

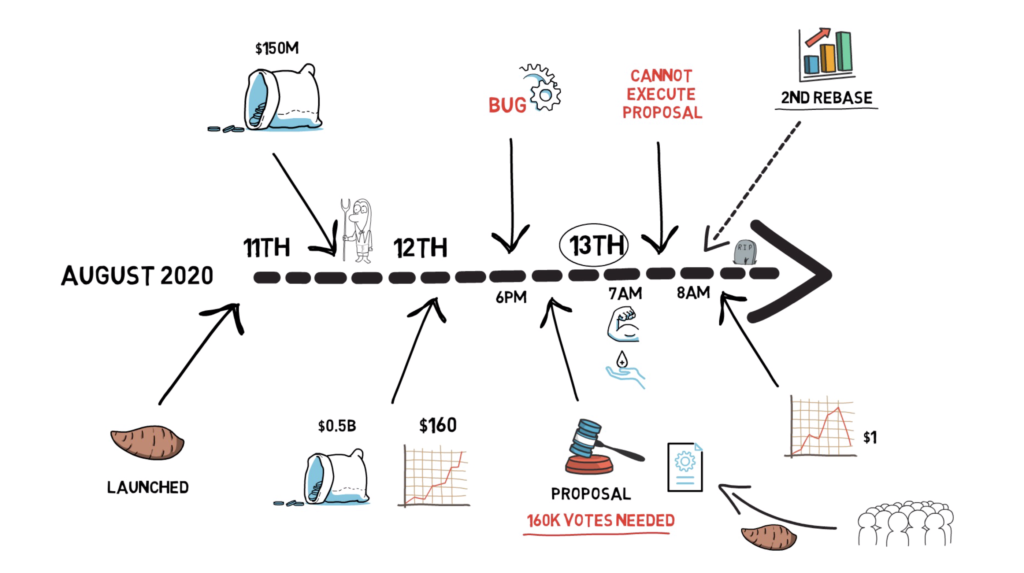

Yam, after only 10 days of development, was launched on the 11th of August 2020.

Rather than allocating a portion of the supply to the founding team, YAM was distributed in the spirit of YFI token: no pre-mine, no founder shares, no VC interest – simply equal-opportunity for everyone participating in their liquidity mining program.

The initial supply of YAM was evenly distributed across eight staking pools: COMP, LEND, LINK, MKR, SNX, WETH, YFI and ETH/AMPL Uniswap v2 LP tokens.

Straight after YAM was launched the money started pouring in, $1M, $10M, $100M, $150M in locked value. Insane APYs began attracting more and more yield farmers.

Even though the YAM contracts didn’t go through a formal audit process, community members started auditing the project by themselves. The staking contracts looked fine, and they found no major red flags.

Following the launch of the initial distribution pools, a second distribution wave was incentivized through a YAM/yCRV Uniswap pool. This pool was needed to provide liquidity for the rebase operation to purchase yCRV for the treasury. It was also necessary for the Uniswap’s price oracle to provide essential input for rebase calculations.

First problem

The next day, 12th of August, the hype continued. Yam was now approaching $0.5B locked in the protocol regardless of super high Ethereum gas prices. The price of YAM itself went as high as $160 before the first rebase.

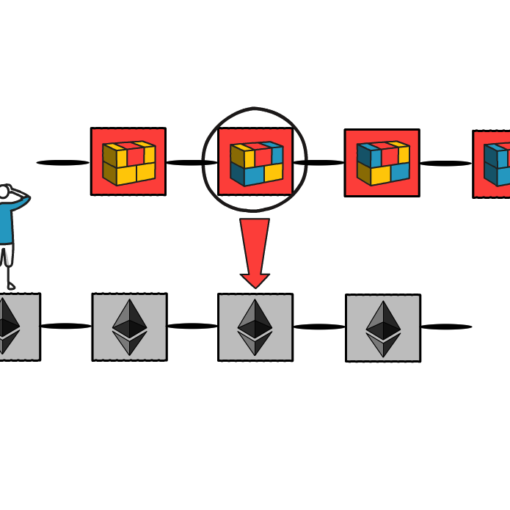

On the same day, around 6PM UTC, a critical bug in the rebase mechanism that would affect all but the initial rebase was found. The bug would cause the rebase mechanism to mint far more YAM than intended and due to the governance model, would result in not being able to reach quorum. This meant that no governance action would be possible, and funds in the treasury would be locked forever.

A governance proposal was created to make a change in the rebase mechanism. 160k votes had to be delegated to vote the proposal in and it all had to be done before the next rebase (8AM UTC 13th Aug). The YAM community mobilised, and more and more YAMs were flowing into the delegation contract.

At the same time, the liquidity providers of the yCRV-YAM poor were asked to withdraw their funds to avoid losing some of their yCRV tokens. Staking of yCRV-YAM LP tokens was blocked to further incentive the users to withdraw their funds from the Uniswap pool.

Final Blow

13th of August, 7AM UTC, after a tremendous overnight effort from the YAM community the proposal reached the required number of votes just before the next rebase. At this point, it looked like the protocol can be saved. Unfortunately, as the proposal was submitted, a new bug that prevented proposal execution was discovered. Following a big rebase and no hopes for achieving quorum by the governance in the future, the Yam price collapsed to under $1 in a matter of minutes.

75% of the liquidity in yCRV-YAM was retrieved before the rebase and effort to retrieve the remaining liquidity was undertaken. Staked funds in the initial pools remained safe and available for withdrawal.

Yam 2.0

A few hours later, the team behind the Yam protocol announced the potential for creating Yam 2.0, this time with well-audited contracts with an audit sponsored by a community grant.

On top of that, even though the governance of the protocol is now impossible, the protocol will live on the Ethereum blockchain, the true power of unstoppable code.

Regardless of the final outcome, it is still really impressive how the Yam protocol was able to attract $600M in capital and mobilise the whole community to help with saving the protocol. All of this in under 48 hours.

On the negative side, some people lost money, either by buying into YAM tokens or by not withdrawing their liquidity from the yCRV-YAM pool in time.

So do you think Yam was a viable money experiment? Can people who lost money only blame themselves for investing in a highly speculative project with clear disclaimers about unaudited contracts?

Or maybe the team behind Yam shouldn’t have released unaudited code in the first place? Comment down below.

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.