So what is Binance Smart Chain? How is it different from Ethereum? And what is CeDeFi all about? You’ll find answers to these questions in this article.

First, let’s see how Binance Smart Chain came into existence.

Binance Chain

In April 2018, Binance – one of the biggest cryptocurrency exchanges, decided to launch their own blockchain – Binance Chain.

The main idea behind Binance Chain was to create a high-speed blockchain able to support large transaction throughput.

To achieve this, the team behind Binance Chain chose the Tendermint consensus model with instant finality and instead of supporting multiple applications, decided to focus on its primary app – Binance DEX.

With DeFi on Ethereum flourishing and Binance DEX not getting as much traction as expected, Binance very quickly realised that the main feature missing from Binance Chain was the ability to run smart contracts and allowing other teams to deploy their own applications.

At this point, Binance made an interesting decision. Instead of trying to add smart contract capabilities to Binance Chain and sacrificing its performance, they decided to launch another chain in parallel to Binance Chain and this is where Binance Smart Chain comes into play.

Binance Smart Chain

Binance Smart Chain launched in September 2020 and in contrast with Binance Chain, was fully programmable and supported smart contracts out of the box.

If you’d like to better understand what smart contracts are and why they are so important you can check this article here.

Creating a completely new smart contract platform from scratch requires years of work and research. Instead of doing that, Binance decided to leverage users’ and developers’ familiarity with Ethereum and forked Ethereum’s go client – geth.

Of course, forking Ethereum without making any changes wouldn’t make much sense, so Binance decided to optimise the new chain for low fees and higher transaction throughput by sacrificing decentralization and censorship-resistance properties of the network.

This was achieved by replacing Ethereum’s Proof-of-Work consensus model with the Proof-of-Staked-Authority model and tweaking a few other parameters such as the block time and the gas limit per block.

Before we jump into the details of Binance Smart Chain, let’s see why some properties of the network had to be sacrificed in the first place. We can understand this better by revisiting the famous Scalability Trilemma.

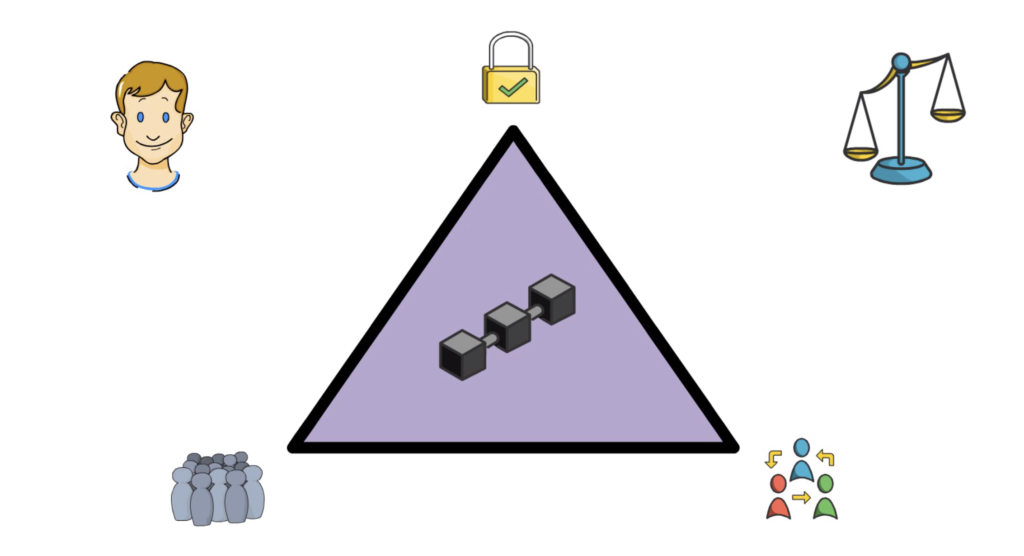

Scalability Trilemma

The Scalability Trilemma is a useful model, introduced by Vitalik Buterin, that helps with visualising what trade-offs have to be made when it comes to different blockchain architectures.

Each blockchain has 3 core properties: security, scalability and decentralization that cannot be achieved simultaneously. So in order to significantly improve one of these properties the other ones have to be sacrificed.

Sharding is an attempt at solving this challenge at the base layer by splitting a blockchain into multiple smaller chains – “shards”. Sharding is one of the scaling approaches chosen by Ethereum and it’s one of the elements of the Eth2 upgrade.

Unfortunately, sharding by itself cannot fully solve the trilemma and even sharded blockchains wouldn’t be able to process hundreds of thousands or even millions of transactions per second without sacrificing decentralization and security.

This is also why the Ethereum community decided to use Layer 2 solutions that can dramatically increase the scalability of a blockchain without sacrificing other properties.

It shouldn’t come as a big surprise that there were a lot of other projects popping up that, despite The Scalability Trilemma, decided to scale up by sacrificing the other 2 properties. One of the most notable examples was EOS.

This is also the approach that Binance Smart Chain decided to go with.

Architecture

Binance Smart Chain, instead of using a Proof-of-Work (PoW) or a Proof-of-Stake (PoS) consensus mechanism, uses a Proof-Of-Staked-Authority (PoSA) model.

In this model, all transactions are validated by a set of nodes called validators. A validator can be either active or inactive. The number of active validators is limited to 21 and only active validators are eligible to validate transactions.

Active validators are determined by ranking all validators based on the amount of BNB tokens they hold. The top 21 validators with the highest amount of BNB become active and take turns validating blocks. This is determined once per day and the set of all validators is stored separately on Binance Chain.

Besides staking BNB tokens themselves, validators can also encourage BNB holders to delegate their BNB tokens to them in order to receive a share of the validator’s transaction fees.

On this note, all transaction fees on Binance Smart Chain are paid in BNB which is the native token of the chain, in a similar way to how ETH is native to the Ethereum blockchain.

In contrast to Ethereum and Bitcoin, there are no block subsidy rewards on Binance Smart Chain. This means that the validators only receive the transaction fees paid in BNB and there is no other fixed reward per block.

Although the PoSA consensus model allows for achieving a short block time and lower fees, it does so at a cost of decentralization and security of the network.

First of all, a user cannot just start validating the state of the blockchain in a similar way as they can do it in Bitcoin or Ethereum.

On top of this, even if a user could just join the network in a permissionless way and start validating transactions, they wouldn’t be able to do it for a very long time on consumer-grade hardware as the state on Binance Smart Chain grows at a much higher rate than the Ethereum’s state.

Now, let’s see how the PoSA-based model allowed the Binance Smart Chain team to change the block time and the block gas limit.

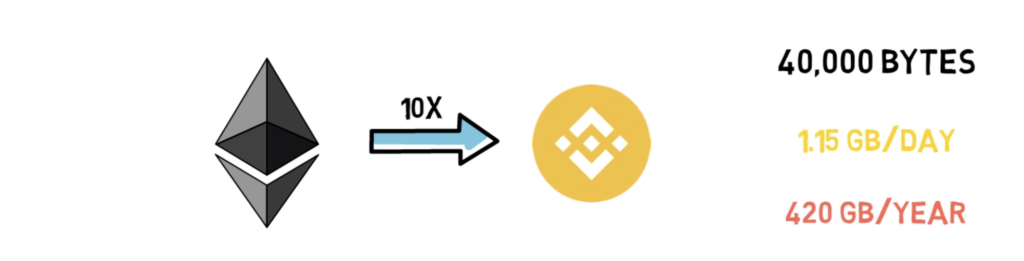

The block time was reduced from around 13s on Ethereum to around 3s on Binance Smart Chain. This allows for higher transaction throughput and faster confirmation time, at a cost of having to store more data.

If implemented on Ethereum, it would also increase the number of orphaned blocks as there would not be enough time to propagate valid blocks across the network from multiple different geographic locations.

When it comes to Binance Smart Chain, however, this is not a problem as validators just take turns validating blocks.

Block gas limit is another important parameter that we discussed in our article about the gas fees. This parameter basically decides how many transactions can fit into one single block. On Ethereum, miners have to come to a consensus and decide what value they want to set it to.

Increasing the block gas limit, similarly to reducing the block time, increases the amount of data produced by the blockchain which makes it harder for individual users to run their own nodes.

Again, this is not a problem on Binance Smart Chain as the 21 validators can just run their nodes on institutional-grade hardware when the state of the blockchain grows beyond what can be handled by consumer-grade hardware.

At the time of writing this article, the gas limit per block is set to 12.5M gas on Ethereum and 30M on Binance Smart Chain.

By knowing both the block time and the gas limit per block we can quickly calculate that the amount of data on Binance Smart Chain increases roughly at a 10-times faster rate than the state on the Ethereum blockchain.

Currently, with an average block size of 40,000 bytes, Binance Smart Chain grows by around 1.15 GB per day which is around 420 GB per year. After a couple of years, this of course eliminates most of the consumer-grade hardware.

Now as we understand a bit more about the Binance Smart Chain architecture, let’s see what CeDeFi is all about.

CeDeFi

As we know, DeFi stands for decentralized finance. CeFi is the opposite of DeFi and as we can probably guess stands for centralized finance. CeDeFi is a term coined by the CEO of Binance that basically describes a mixed solution between centralized and decentralized finance which Binance Smart Chain is a good example of.

So what are the benefits of such a solution?

CeDeFi allows users to get a feel for using DeFi without paying high transaction fees. Low fees encourage users to play with multiple different DeFi protocols such as decentralized exchanges, lending protocols, liquidity aggregators, yield farming tools and others.

On top of this, CeDeFi makes users familiar with common DeFi tools like Metamask and block explorers.

It also allows new teams to deploy their smart contracts for a fraction of a cost when compared to what they would have to pay on the Ethereum blockchain. This way they can easily test and get feedback on their projects. Testing within an ecosystem with actual economic incentives usually works much better than just testing on a testnet.

Binance Smart Chain and CeDeFi have recently started gaining a lot of popularity. This is mainly driven by the high transaction cost on Ethereum that priced out some of the users.

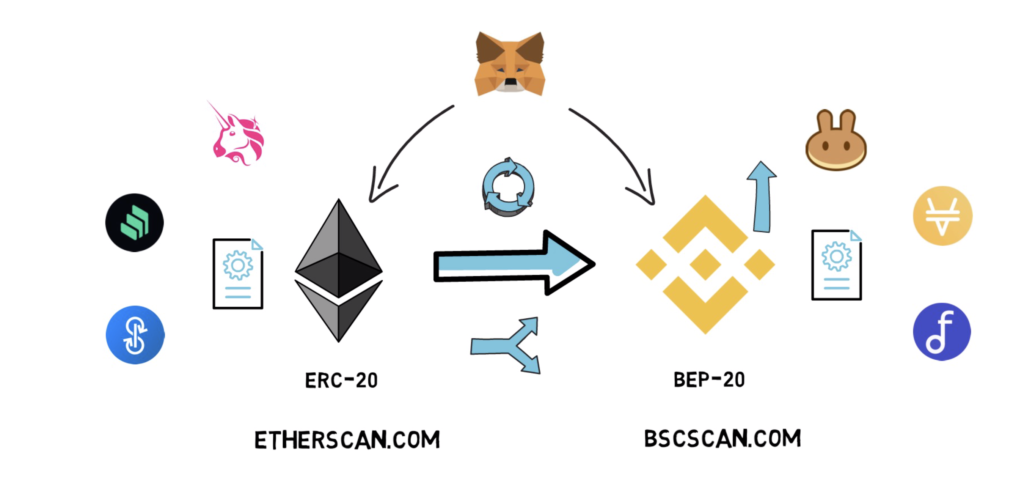

As we know, Binance Smart Chain is a fork of Ethereum and therefore allows for running exactly the same smart contracts like the ones on Ethereum.

This allowed the network to quickly bootstrap its ecosystem by essentially either reusing or forking all popular Ethereum services and applications.

Users can connect to Binance Smart Chain based dApps by switching their network in Metamask. They can look up their transactions on bscscan.com which is pretty much a copy of etherscan.com. They can trade on Pancakeswap – a fork of Uniswap. They can lend and borrow on Venus – a fork of Compound and yield farm via Autofarm – a protocol that resembles Yearn Finance.

Binance Smart Chain, similarly to Ethereum, also allows for creating new tokens using their BEP-20 standard – Ethereum’s ERC-20 counterpart.

Some Ethereum-based projects also quickly saw the opportunity for expanding their reach to Binance Smart Chain, at a minimal cost. 1Inch – a liquidity aggregator – has recently decided to also launch on Binance Smart Chain.

Summary

It’s clearly visible that Binance Smart Chain was able to make quite a lot of traction and attract a decent number of users and trading volume in a very short amount of time.

A decision to fork Ethereum and allow users and developers to interact with DeFi tools and protocols they are already familiar with was quite clever.

The timing was also extremely good. The popularity of Ethereum combined with most Ethereum scaling solutions still in progress and a roaring bull market resulted in high transaction fees that priced out smaller users and forced them to find a different option if they still wanted to participate in DeFi.

On top of this, Binance was able to leverage its position as one of the top cryptocurrency exchanges and make it easy for its millions of users to easily withdraw BNB and other tokens directly to Binance Smart Chain.

The main question to ask here is if this is a short term growth caused only by high transaction fees on Ethereum or a longer-term user acquisition?

At this point, it’s hard to say, but two main things pointing at the former are Ethereum’s layer 2 scaling solutions and the Eth2 scaling roadmap.

Both of these can dramatically reduce the transaction fees on Ethereum without sacrificing other properties like security and decentralization.

We can already get a feel for it with Matic (a.k.a. Polygon) and Loopring attracting more and more users and trading volume. This trend should only keep escalating with other layer 2 solutions getting more traction and new ones like Optimism fully launching in a matter of weeks.

With millions of new users entering the cryptocurrency space, it’s also extremely important to make sure they are aware of the differences between DeFi and CeDeFi and are able to make their own decisions.

At the end of the day, we have to ask ourselves the question. What’s the main point of using a blockchain if it’s not fully decentralized and permissionless? Auditability? Maybe, but is this really the main value proposition of the whole cryptocurrency space?

It will clearly be interesting to see how DeFi and CeDeFi play out.

So what do you think about Binance Smart Chain? Does CeDeFi have a future?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.