Intro

Did you know that when you make a move on Ethereum, there’s a hidden, high-stakes game playing out?

And what if I told you this game could be the secret to cheaper, more efficient transactions or, sometimes, the cause behind those unexpected high fees and delays?

Meet MEV, a concept that’s reshaping the Ethereum we know.

But who drives this game? What roles do searchers, builders and proposers play? How do Flashbots come into the picture, and what’s their mission? And does MEV provide extra incentives for validators or create an existential threat to the decentralisation of the whole network? You’ll find answers to these questions and more in this post.

And we promise you, by the end of this post, Ethereum will never look the same to you again.

What is MEV

To define the concept of MEV, let’s first look at the simplified model that many people believe represents how Ethereum transactions work.

At its core, when you initiate a transaction, it first enters the ‘mempool’. Think of the ‘mempool’ as a waiting room for pending transactions. When building a new block, the block proposer can choose and prioritise transactions from the mempool based on their transaction fees.

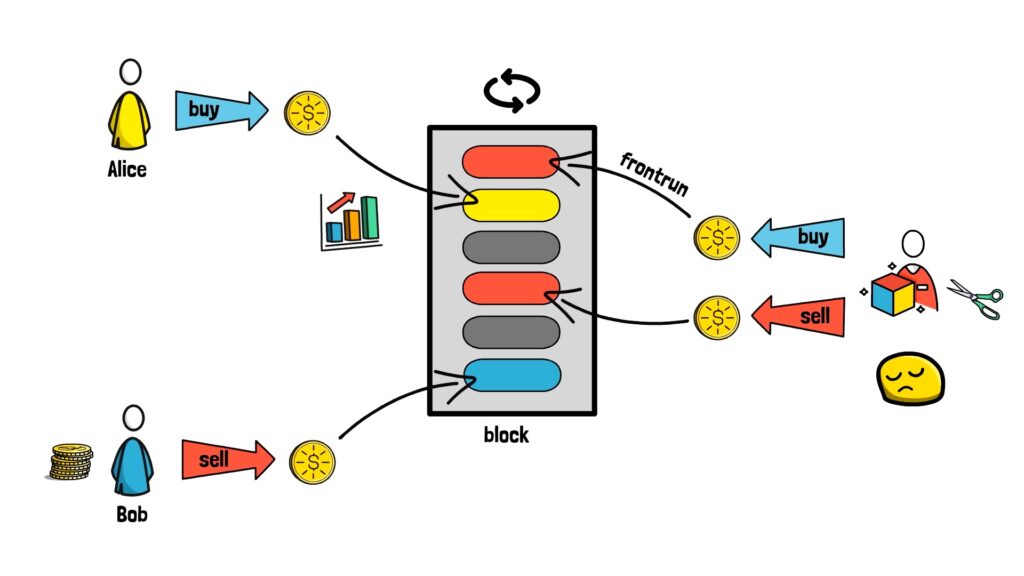

However, MEV introduces a unique twist. Block proposers can not only choose which transactions to include and their order within a block but also add their own. The sequence of these transactions can occasionally yield substantial profits.

Imagine this scenario: Alice purchases a large amount of a specific token. Following her, Bob opts to sell the same token. If Bob’s transaction is processed after Alice’s, he capitalises on a better sale price due to the increased demand Alice’s purchase creates. Spotting such opportunities, a block proposer might rearrange the order of transactions to benefit and take a ‘cut’. The proposer can achieve this by inserting its own buy transaction just before Alice’s transaction and placing a sell transaction after Alice’s transaction and right before Bob’s transaction.

In this rather nasty example, the block proposer essentially frontruns Alice’s transaction, benefiting from the price movement they can predict and influence.

This additional profit, resulting from altering the transaction sequence, is termed MEV, which stands for Maximal Extractable Value.

Understanding MEV is extremely important as it creates various challenges for a network like Ethereum.

From an end-user perspective, MEV can manifest in different ways, including affecting trade executions. For instance, if you receive fewer tokens from a DEX trade than initially anticipated, it could be due to MEV.

From the network’s standpoint, MEV risks pushing a decentralised system toward centralisation. Under proof-of-work, mining pools were incentivised to become highly specialised, potentially leading to centralization among them. This draws uncomfortable parallels with traditional finance, moving away from the aspirational, transparent, decentralized finance model.

Outside of transaction ordering, block proposers can also decide to include or exclude a particular transaction, either by prioritising one offering higher fees or censoring specific transactions.

In general, MEV can be extracted and classified in a number of ways.

MEV Strategies

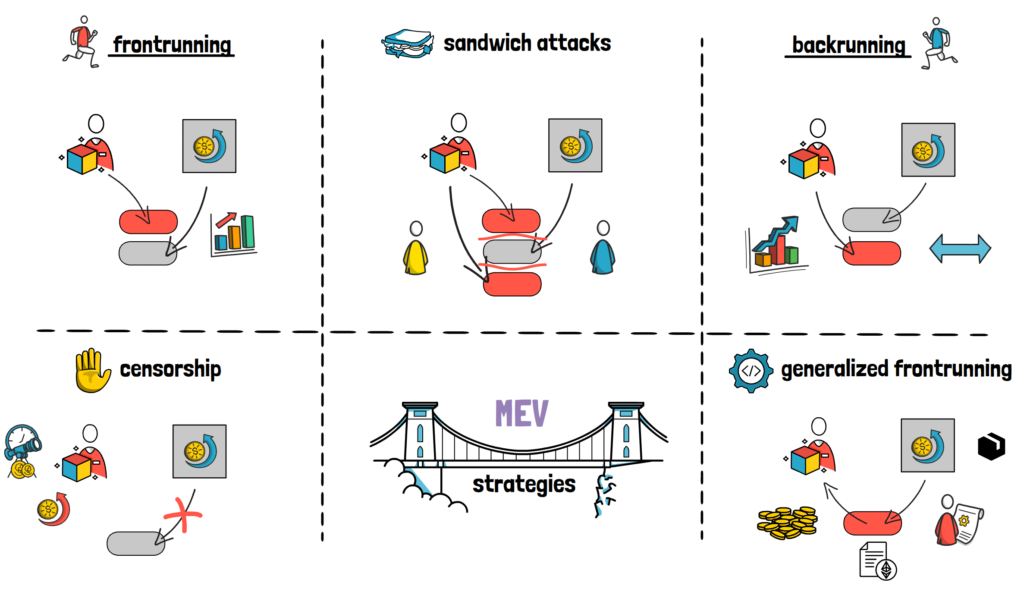

Let’s visit the realm of MEV with these common strategies:

- Frontrunning: Proposers spot a pending transaction in the mempool that can shift the market and jump right ahead to benefit from the price change.

- Backrunning: Opposite of frontrunning, proposers position their transaction right after a significant one, often exploiting potential price discrepancies or arbitrage opportunities between exchanges.

- Sandwich Attacks: A combination of frontrunning and backrunning. Proposers see a large order, place their own order ahead of it (frontrun) and then place another order after it (backrun). Essentially, they “sandwich” the user’s transaction. That is what happened in our previous Alice and Bob example.

- Censorship: A proposer could censor transactions to benefit from MEV elsewhere, demand higher fees or manipulate oracles.

- Generalised frontrunning: A proposer could execute any profitable transaction for themselves, even without fully understanding the transaction content. This strategy is possible by simulating transaction execution and determining if the caller of a given smart contract method ends up with more funds than before the execution.

MEV strategies can sometimes be categorized as toxic or non-toxic.

Toxic MEV is the type of MEV that has negative effects on the blockchain ecosystem and its users. Examples of toxic MEV include:

- Front-Running,

- Sandwich Attacks,

- Censorship

With front-running and sandwich attacks, users end up having worse execution of their transactions. With censorship, the decentralised and stable nature of the ecosystem is at risk.

Non-toxic MEV, on the other hand, refers to the forms of MEV that don’t negatively impact users or the integrity of the blockchain.

Back-running serves as a prime example of this. However, it’s worth noting that the classification of MEV as ‘non-toxic’ can be subjective.

As an example, while arbitrage and back-running lead to more efficient prices, they also lead to losses for liquidity providers.

As we can see, it’s helpful to classify MEV as it allows us to understand its impact better.

Before we jump into the current MEV landscape, let’s look at how we got here and how the MEV space evolved over time.

The PGA Era

Though MEV has been an intrinsic part of Ethereum since its inception, its prominence surged notably from 2018 onwards, especially with the rise of DeFi and the introduction of flash loans.

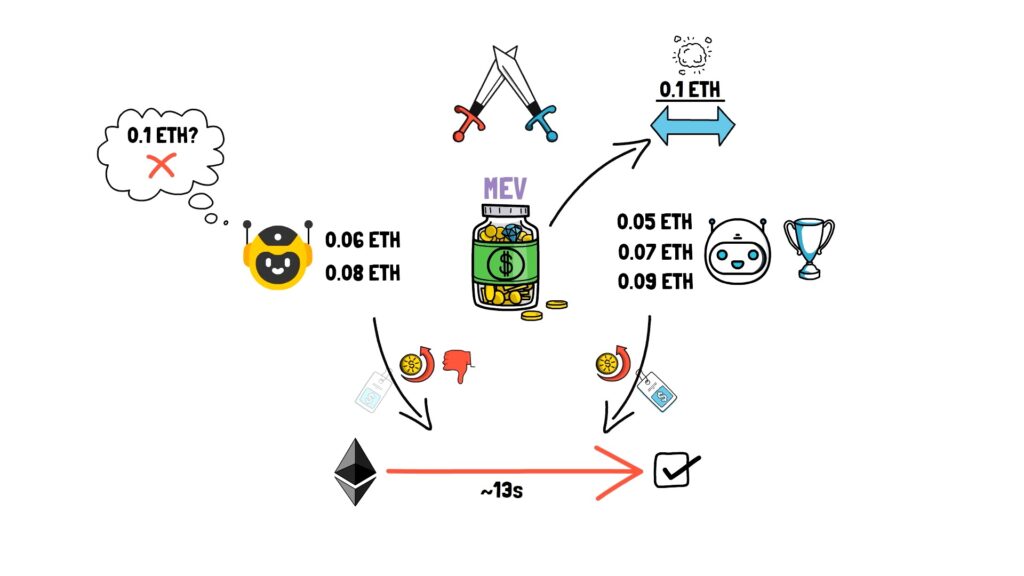

In these early days, MEV opportunities were primarily seized by outbidding rivals in the public mempool, marking the era known as PGA, or Priority Gas Auction.

Imagine two MEV bots seeing a profitable MEV opportunity. Let’s say there is a cross-DEX arbitrage that can capture 0.1 ETH of value. Both bots are incentivised to keep increasing their bids until the opportunity becomes unprofitable.

Now, imagine this intense standoff but compressed within Ethereum’s typical block time, which was averaging 13 seconds pre-Merge. Once a bot secures its transaction in a confirmed block, the profit window vanishes.

In this scenario, while the winning bot pays the full transaction cost to secure its spot in the block, the competing bot often finds its transaction included as well – but as a failed attempt, still incurring some transaction fee.

Extrapolate this scenario to hundreds or even thousands of bots competing for analogous profitable opportunities, and we can quickly see why this became a huge problem. Such aggressive bidding not only escalated transaction fees but also contributed to network congestion, detrimentally impacting Ethereum’s regular users.

This chaotic chapter of early MEV and its Priority Gas Auctions was well documented in “Flash Boys 2.0”. The name of this paper was inspired by the famous Michael Lewis book Flashboys, which dives deep into the early days of high-frequency trading – a concept with a lot of analogies to the MEV world.

The Flashbots Era

To mitigate problems caused by PGAs, a group of Ethereum community members rallied around and formed Flashbots with the primary goal of addressing the negative externalities of MEV in a transparent and community-driven manner.

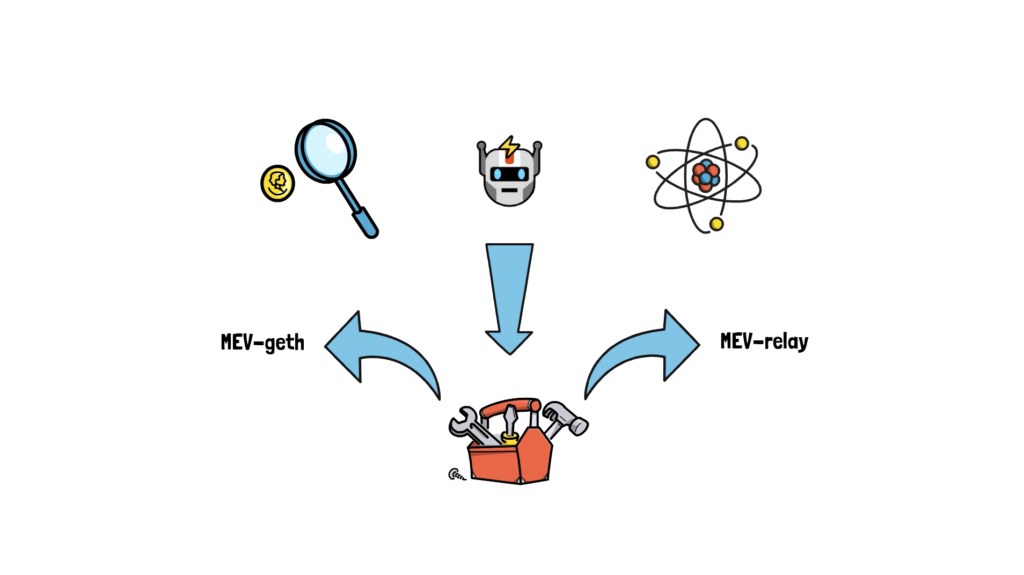

After deeply investigating MEV to understand its dynamics, the Flashbots community introduced two integral tools: MEV-Geth and MEV-Relay.

MEV-Geth is a modified version of the Ethereum Geth client that enables miners to communicate directly with the MEV searchers and prioritise their transaction bundles.

These bundles are groups of transactions packaged together by searchers to extract profitable MEV opportunities. MEV-Relay, on the other hand, is a relay network facilitating the submission of these bundles from searchers to miners.

The term “searchers” refers to entities or algorithms searching the Ethereum mempool for MEV opportunities, crafting specialised transaction bundles to maximise potential profits.

With MEV-Geth and MEV-Relay, miners, instead of just relying on the transactions in the mempool, would run these additional pieces of software to gain access to another transaction flow that otherwise wouldn’t be visible in the mempool.

A miner would look at the mempool and transaction bundles coming through MEV-Relay and construct the most profitable block.

Together, these tools aimed to create a more organised, transparent, and efficient framework for MEV extraction, reducing network congestion and aligning incentives among different participants.

Over time, MEV-Geth started gaining more and more market share, reaching around 90% of the mining power.

Although it looked like the MEV landscape matured and the main pain points were addressed, the space was ready for a big disruption caused by one of the most significant changes to Ethereum itself – the shift from Proof-of-Work to Proof-of-Stake and the Merge.

The Post-Merge Era

In the post-Merge world, the concept of miners on Ethereum ceased to exist.

Validators were now the entities responsible for adding blocks to the chain.

Alongside this shift, MEV evolved from “Miner Extractable Value” to “Maximal Extractable Value.”

Anticipating these changes, Flashbots, together with client teams and the Ethereum Foundation, commenced the development of a new protocol dedicated to Proof-of-Stake Ethereum called MEV-Boost, which was activated as soon as the Merge was completed.

MEV-Boost is a type of proposer-builder separation (PBS). PBS is a design philosophy that allows validators to effectively use third-party block builders for their block-building duties.

A block builder is a new role introduced by PBS. Using MEV-Boost, validators can sell blockspace to specialised third parties called block builders, which collect, sequence and introduce transactions to produce a block. Builders want to produce a block that maximises the fees collected.

MEV-Boost works by allowing validators to pick the highest-paying block offered by builders. Builders then compete to produce blocks. The validator then chooses the highest-paying block and proposes it to the network.

Unlike MEV-Geth, where miners had to run Flashbots software alongside their client, MEV-Boost operates as an add-on, allowing any validator to use it regardless of their chosen consensus and execution clients.

Yet again, the solution started quickly gaining significant adoption, reaching around 90% of the network participants.

MEV Supply Chain

Although the MEV ecosystem undergoes frequent changes, let’s paint a comprehensive picture of the current MEV landscape by examining the MEV supply chain step by step.

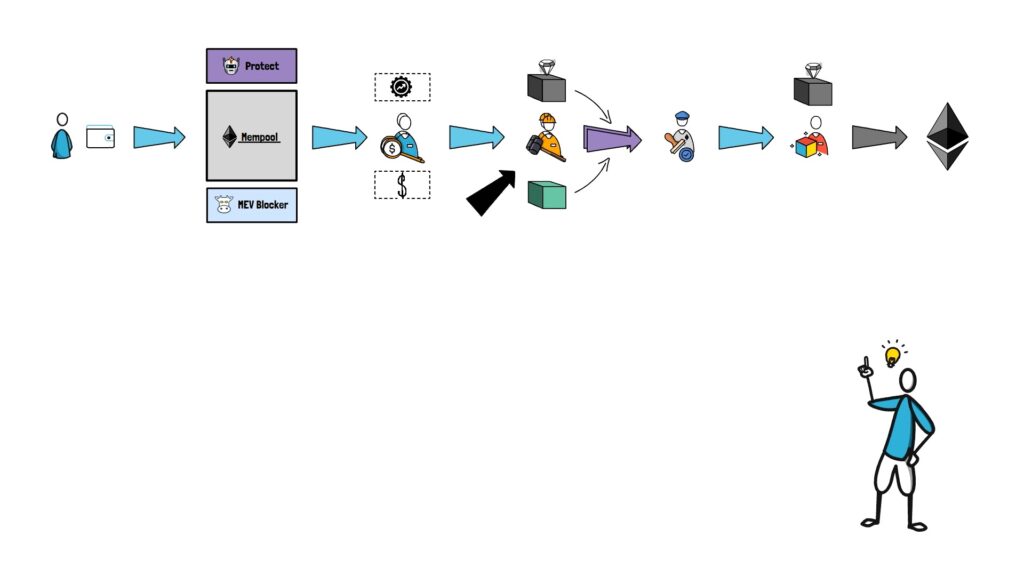

The journey begins with a user initiating a transaction from their wallet. Typically, this transaction ends up in the mempool, although alternative private mempools such as Protect (by Flashbots) and mev-blocker (by Cowswap) are also available.

This is where searchers come into play. They search for the most optimal and profitable transaction bundles and send them to the builders.

The builder, with access to multiple searchers, potential private order flows, and the mempool itself constructs the most valuable block it can and sends it to a relay.

Validators are connected to multiple relays and listen to all the incoming blocks from multiple builders.

The validator that becomes the next block proposer selects the most profitable block and proposes it.

As we can see, the current landscape diverged significantly from the early, straightforward Ethereum model of user → wallet → mempool → miner.

Although this system is more complicated, it allows participants to benefit from builders’ work without needing to trust them.

The Future of MEV

Outside of the current MEV landscape, It’s also worth discussing the future of this space.

One of the main challenges in the current landscape is builder centralisation. Currently, the five main builders build around 90% of Ethereum blocks.

Additionally, exclusive order flow and cross-domain MEV present new, emerging centralization threats to not only Ethereum but many other chains.

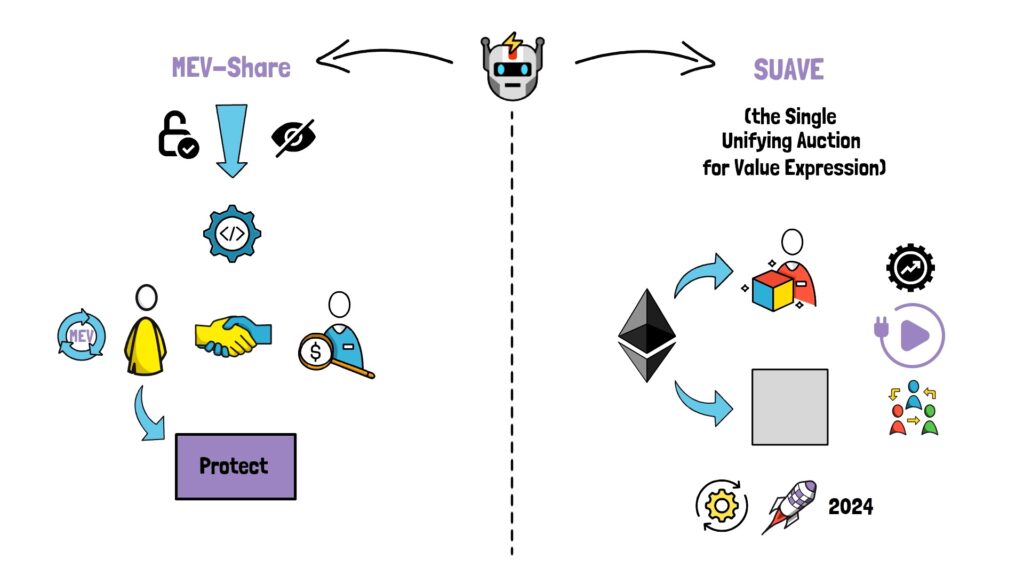

To address these problems, Flashbots started working on two new initiatives: MEV-Share and SUAVE.

MEV-Share focuses on creating a permissionless and private matchmaking protocol between users and searchers where users can benefit directly from the MEV they generate. Users can access MEV-Share automatically by sending transactions through Flashbots Protect.

SUAVE (the Single Unifying Auction for Value Expression) unbundles the mempool and block builder roles from existing blockchains and offers a highly specialised and decentralised plug-and-play alternative. SUAVE is currently being developed, with a first release expected sometime in 2024.

There are also some optimisations that can be applied to MEV. One of them is MEV-Burn, proposed by Justin Drake.

It describes a simple enshrined PBS add-on to smooth and redistribute MEV spikes – a design similar to EIP-1559.

Speaking about enshrined PBS, it will be interesting to see its impact on existing out-of-protocol implementations of PBS, such as MEV-Boost and the MEV space in general, once it’s materialised.

We’ll, for sure, dive deeper into some of these topics in the following posts.

Summary

To sum up, MEV, with its intricate dynamics, is a fundamental aspect of the Ethereum machine. The MEV extraction is a perpetual dance, with searchers, builders and block proposers on a relentless quest for MEV rewards, countered by the Ethereum community’s pursuit of a balanced, fair and efficient ecosystem.

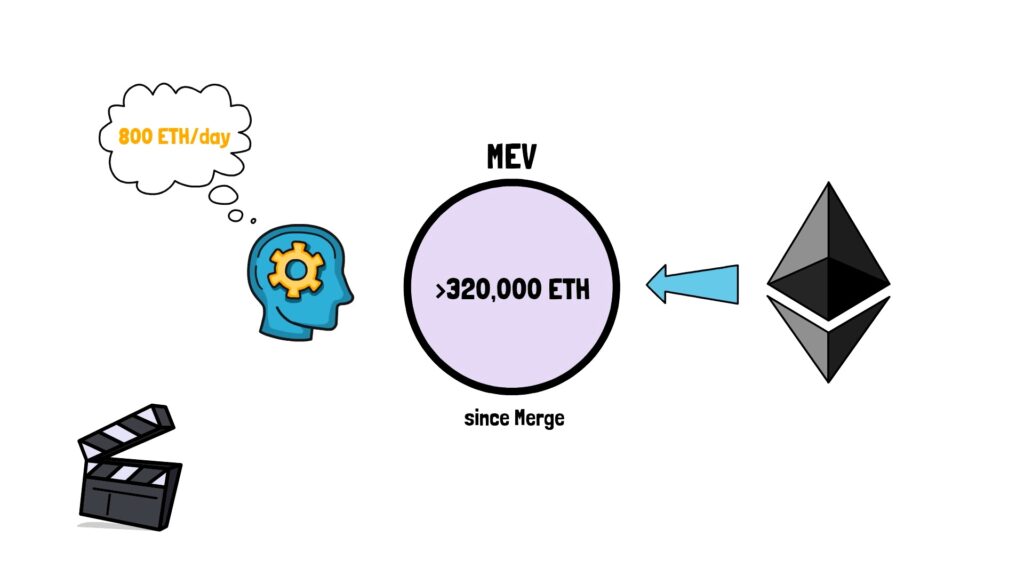

At the time of this post, the size of MEV opportunities on Ethereum itself lay in upwards of 320,000 ETH – and this is just since the Merge. That’s roughly 800 ETH/day of MEV.

The future is still uncertain: Will we advance towards an MEV utopia, decentralising all aspects of the MEV supply chain and returning the generated MEV to users? Or might we see an MEV dystopia emerge, where a few centralised entities control block production across all significant chains, extracting value from unsuspecting users?

It’s going to be fascinating to watch how the MEV landscape evolves.

If you enjoyed reading this post, check out Finematics on Youtube and Twitter.