So what are derivatives? Why are they important? And what are some of the most popular derivatives protocols in defi? You’ll find answers to these questions in this article.

Derivatives

Derivatives are one of the key elements of any mature financial system. As the name suggests derivatives derive their value from something. This “something” is usually the price of another underlying financial asset such as a stock, a bond, a commodity, an interest rate, a currency or a cryptocurrency. Some of the most commonly used derivatives are forwards, futures, options and swaps.

There are two main use cases for derivatives: hedging and speculation. Hedging allows for managing financial risks. To understand hedging a bit better let’s revisit one of the commonly used examples.

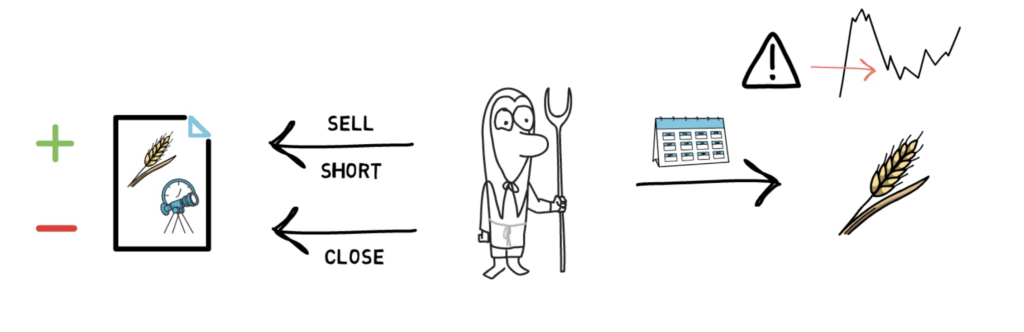

Imagine a farmer that primarily focuses on growing wheat. The wheat price can fluctuate throughout the year depending on the current supply and demand. As the farmer plants wheat, they are committed to it for the entire growing season which presents them with a big risk in case the price of wheat is low when the harvest time comes.

To accommodate this risk, the farmer will sell short wheat futures contracts for the amount that they predict to harvest. As the time of harvest approaches, the farmer will close their position and incur a profit or a loss depending on the price of wheat.

If the price of wheat is lower than initially anticipated the short position makes a profit that offsets the loss from selling the actual wheat.

If the price of wheat is higher, the short position will be at a loss but the profit from selling the wheat offsets that loss.

What is important to understand is that no matter what happens to the wheat price the farmer will end up with a predictable income.

To stay in the agricultural world, yield farmers in decentralized finance can also use hedging to offset a potential loss that can occur if the price of one of the tokens used for yield farming loses its value in relation to another token. This can happen, for example, while providing liquidity to an automated market maker like Uniswap and is known as impermanent loss.

Besides our agricultural examples, derivatives allow other crypto companies to hedge their exposure to different cryptocurrencies and run more predictable businesses.

The other popular use case for derivatives is speculation.

In a lot of financial instruments including derivatives, speculation can represent a significant amount of traded volume. This is because derivatives offer an easy exposure to particular assets that may be hard to access otherwise, for example, trading oil futures instead of actual barrels of oil. They can also provide easy access to leverage – a trader can purchase a call or a put option by providing only enough funds to cover the option premium and gain exposure to a significant amount of the underlying asset.

Speculators are important market participants as they provide liquidity to the market and allow people, who actually need to buy a particular derivative to hedge their risk, to easily enter and exit the market.

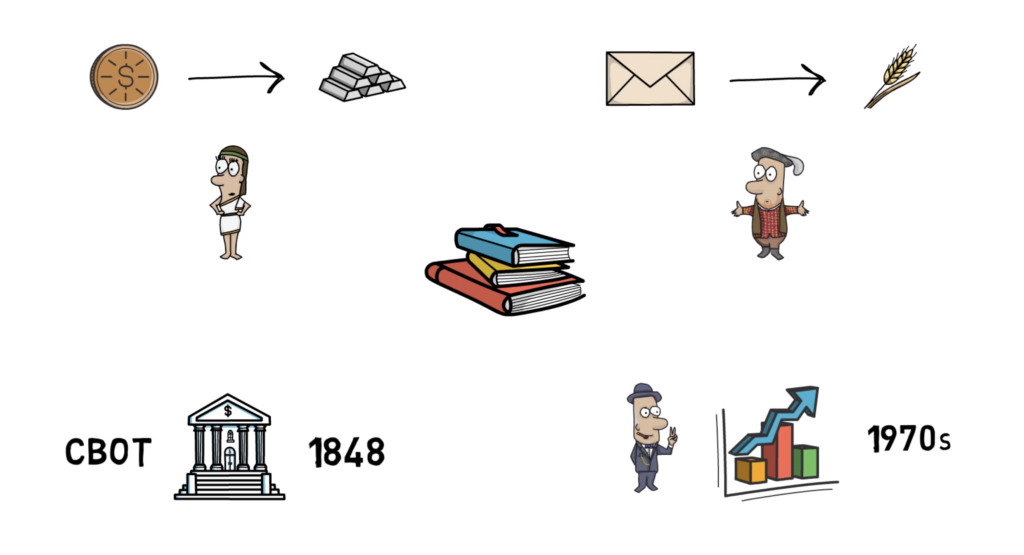

Derivatives have a long and interesting history. From clay tokens representing commodities traded by the Sumerians, through the use of “fair letters” to buy and sell agricultural commodities in Medieval Europe, to the establishment of the Chicago Board of Trade (CBOT) in 1848 – one of the world’s oldest futures and options exchanges.

When it comes to more modern times, derivatives have been one of the major forces that drive the whole financial industry forward since the 1970s.

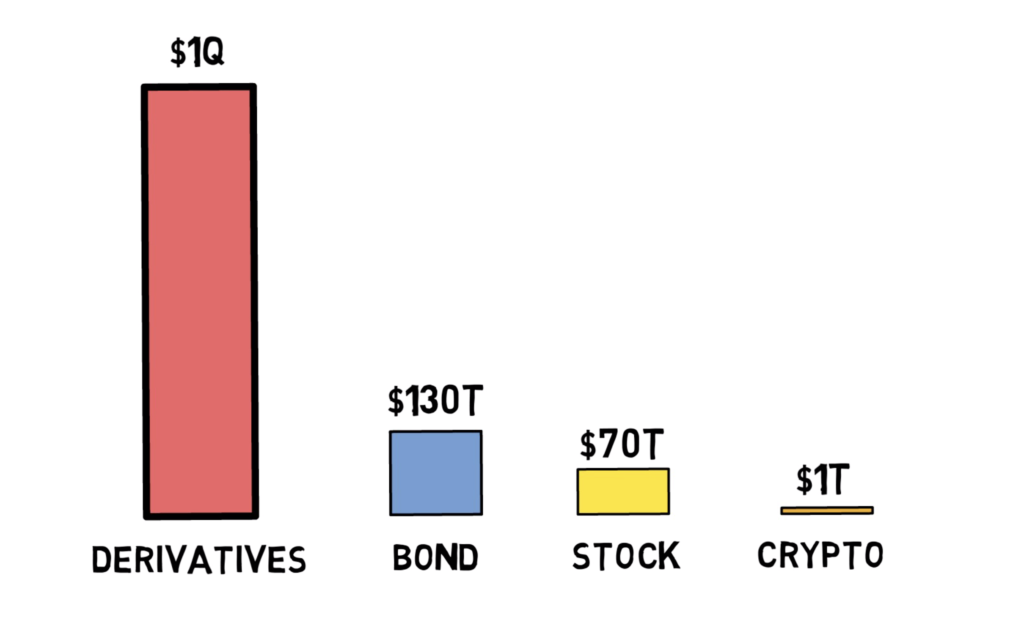

The total market size of all derivatives is estimated to be as high as $1 quadrillion which completely dwarfs any other market including the stock or bond markets and of course the tiny cryptocurrency market that has just recently touched the $1 trillion mark.

Every growing market naturally develops its own derivatives market that can end up being an order of magnitude bigger than its underlying market.

This is also why a lot of people in the decentralized finance space are extremely bullish on the potential of decentralized derivatives that, in contrast to traditional finance, can be created by anyone in a completely permissionless and open way. This in turn increases the rate of innovation that has been stagnating in traditional finance already for a while.

Now, as we know a bit more about derivatives, let’s jump into some of the most important derivatives protocols in DeFi.

Synthetix

Synthetix is usually the first protocol that comes to our minds when talking about derivatives in DeFi.

Synthetix allows for creating synthetic assets that track the price of their underlying assets. The protocol currently supports synthetic fiat currencies, cryptocurrencies and commodities that can be traded on trading platforms such as Kwenta, DHedge or Paraswap.

Synthetix model is based on a debt pool. In order to issue a particular synthetic asset, a user has to provide collateral in the form of the SNX token.

The protocol is highly overcollateralized – currently at 500%. This means that for each $500 of SNX locked in the system, only $100 worth of synthetic assets can be issued. This is mainly to absorb any sharp price changes in synthetic assets and the collateralization ratio will be most likely lowered in the future.

Synthetix is also one of the first DeFi projects leading the effort of moving to layer 2 in order to lower the gas fees and make the protocol more scalable.

There is currently around $1.8B locked in the synthetix protocol – the biggest number across all defi derivatives protocols by a wide margin.

UMA

UMA is another protocol that enables the creation of synthetic assets.

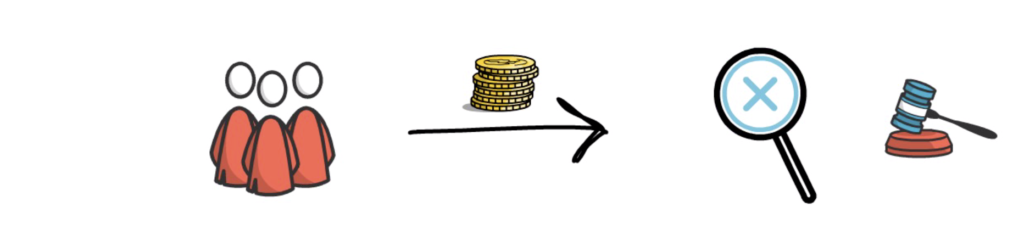

The main difference here is that UMA, instead of highly overcollateralizing the protocol, relies on liquidators, who are financially incentivised, to find improperly collateralized positions and liquidate them.

UMA’s model allows for creating “priceless” derivatives. This is because the model doesn’t rely on price oracles – at least not in the optimistic scenario. This in turn allows for adding a very long tail of synthetic assets that otherwise wouldn’t have a reliable price feed hence it wouldn’t be possible to create them in Synthetix.

There is currently over $63M of total value locked in UMA’s smart contracts.

Hegic

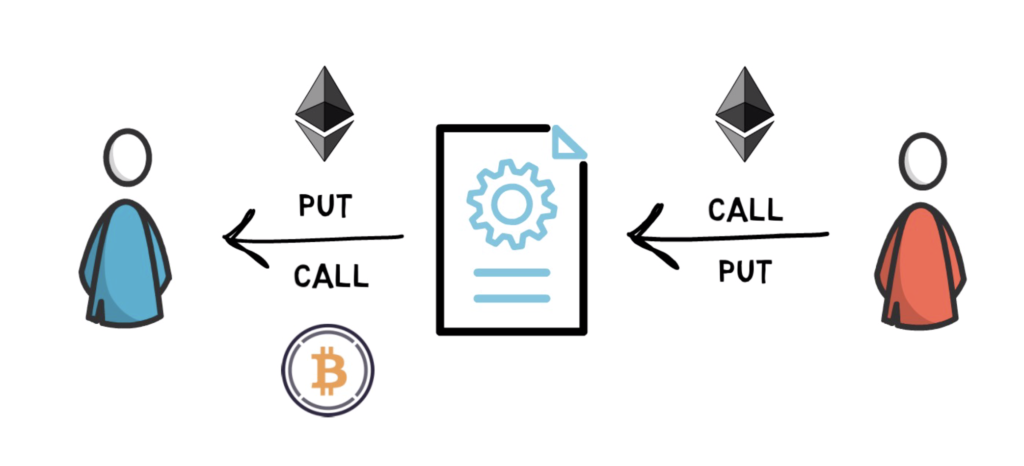

Hegic is a relatively new defi project that allows for trading options in a non-custodial and permissionless way.

Users can buy put or call options on ETH and WBTC. They can also become liquidity providers and sell ETH call and put options.

Three months after the launch, Hegic had almost $100M in total value locked in the protocol, a total cumulative options trading volume of ~$168M and generated over $3.5M in fees.

Interestingly, Hegic has been developed by a single anonymous developer which again shows the power of DeFi where, in contrast to traditional finance, even a single person or a small group of people can build a useful financial product.

Opyn

Another DeFi project that allows for trading options is Opyn.

Opyn, launched in early 2020, started from offering ETH downside and upside protection which allowed users to hedge against ETH price movements, flash crashes, and volatility.

They’ve recently launched a V2 of the protocol that offers European, cash-settled options that auto-exercise upon expiry.

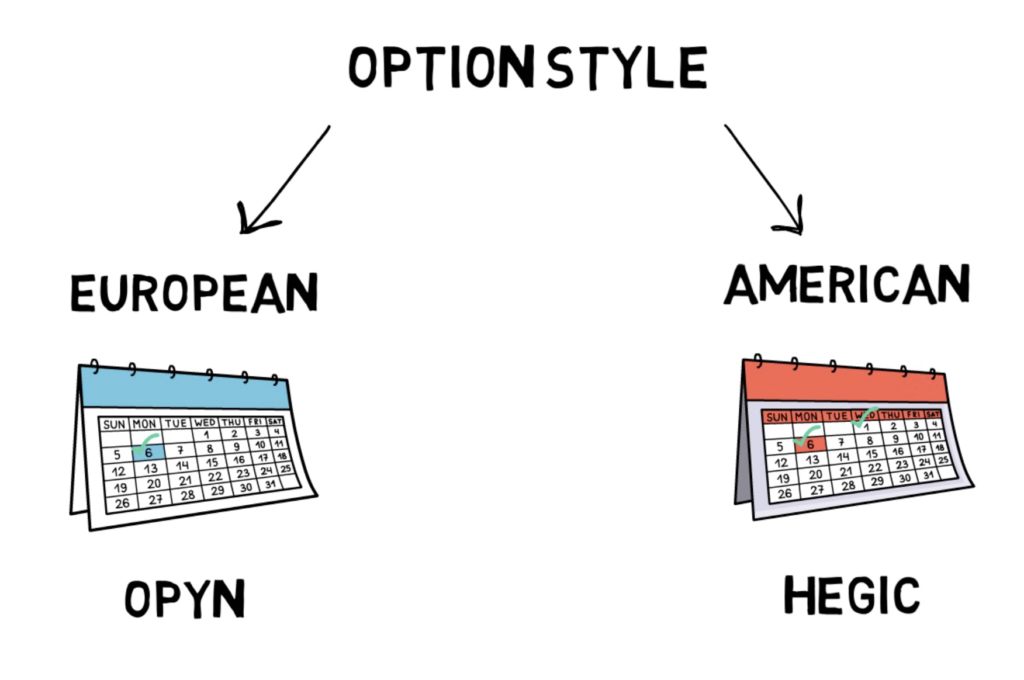

There are 2 main option styles: European and American.

European options can only be exercised at the time of expiration whereas American options can be exercised at any time up to the expiration date.

In contrast to Opyn, Hegic uses American style options.

The Opyn protocol auto-exercises options that are in the money, so option holders don’t need to take any action at or before the expiration date.

Since its first release, the protocol had over $100M in traded volume.

Perp

Perpetual is yet another fairly new entrant into the decentralized derivatives space.

As the name suggests Perpetual allows for trading perpetual contracts. A perpetual contract is a popular trading product in the cryptocurrency space used by well-known centralized platforms such as Bitmex, Binance and Bybit. It is a derivative financial contract with no expiration or settlement date, hence it can be held and traded for an indefinite amount of time.

Perpetual Protocol, at the moment, allows for trading ETH, BTC, YFI, DOT and SNX.

Trades are funded and settled in USDC – a popular stable coin in the defi space.

All trades on Perpetual Protocol are processed using the xDai Chain – a layer 2 scaling solution. This allows for incredibly low gas fees that are currently subsidised by the protocol.

This means that currently there are no gas fees while trading on Perpetual Protocol. Paying the gas fee is only required when depositing USDC onto the platform.

The protocol has been live for only just over a month but it has already managed to achieve over $500M in volume and $500k in trading fees.

dYdX

dYdX is a decentralized derivatives exchange that offers spot, margin and more recently – perpetuals trading.

dYdX architecture combines non-custodial, on-chain settlement with an off-chain low-latency matching engine with order books.

Besides that, the dYdX team has been building a new product for Perpetual Contracts on Layer 2, powered by StarkWare’s ZK Rollups that is due to launch in early 2021.

The total cumulative trade volume across all products on dYdX reached $2.5 billion in 2020, a 40x increase when compared to the previous year.

dYdX has recently raised $10M in a Series B round led by Three Arrows Capital and DeFiance Capital.

BarnBridge

BarnBridge is a risk tokenizing protocol that allows for hedging yield sensitivity and price volatility.

This can be achieved by accessing debt pools of other defi protocols, and transforming single pools into multiple assets with different risk/return characteristics.

BarnBridge, at the moment, offers two products:

Smart Yield Bonds: interest rate volatility risk mitigation using debt based derivatives

And Smart Alpha Bonds: market price exposure risk mitigation using tranched volatility derivatives.

There is currently over $350M of total value locked in the protocol.

BarnBridge is also running a liquidity mining program that distributes its token – BOND – to all users who stake stable coins, Uniswap BOND-USDC LP tokens or BOND tokens on their platform.

Summary

As we mentioned earlier, the Derivatives Market in traditional finance is huge and it will be interesting to see how big it will become in decentralized finance.

It is also amazing to see more and more projects launching derivatives protocols and being able to create new and exciting financial products in a permissionless and decentralized way.

One more important thing – interacting with new DeFi protocols can be risky. So before using any of the protocols mentioned in this article always do your own due diligence as most of these projects are still in their beta or even alpha versions.

So what do you think about derivatives in DeFi? How big will they become in the future? Would you like to see a deep dive into one of the projects we mentioned in this article?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.