Introduction

On the 9th of March 2020, the New York Stock Exchange halted trading for 15 minutes as the result of triggering level 1 circuit breaker caused by a 7% drop in the S&P 500. The last time the circuit breaker kicked in was back in October 1997.

What are the Circuit Breakers?

Circuit Breakers are automatic mechanisms that prevent the stock market from a free fall by halting trading for a predefined time.

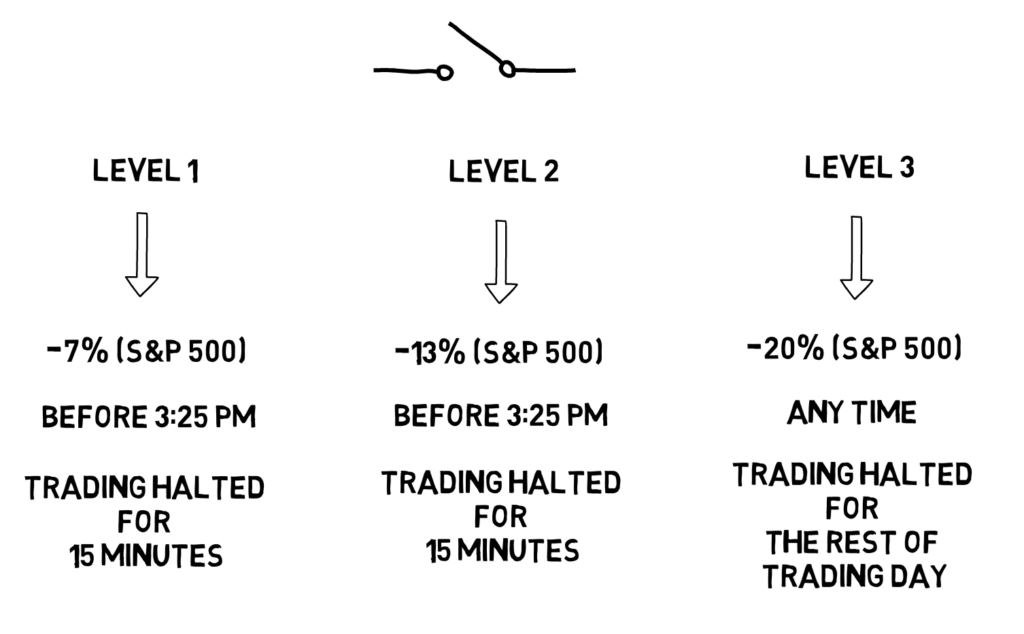

The New York Stock Exchange has 3 levels of market-wide circuit breakers.

Level 1 market-wide circuit breaker is triggered if the S$P 500 falls 7% from its previous close before 3:25 pm on a trading day. It halts trading for 15 minutes.

Level 2 market-wide circuit breaker kicks in when the market plunges 13% (also before 3:25 pm). It halts trading for an additional 15 minutes.

Level 3 market-wide circuit breaker comes into effect if the market tanks 20% in a day and can be triggered at any time even after 3:25 pm. If this circuit breaker kicks in, trading is halted for the rest of the trading day.

Besides having market-wide circuit breakers based on the S&P 500 price, individual stocks also have their own circuit breakers, with the trigger level determined by the price of the stock.

Circuit breakers are not only limited to the NYSE. In fact, most of the exchanges including futures exchanges have their own circuit breakers. The noticeable exceptions are the cryptocurrency exchanges that usually do not implement circuit breakers as they are not regulated in the same way as more traditional exchanges.

Why would you stop the stock market in the first place?

The main reason is to stop panic selling. The market usually plunges by 7 or more % based on either significant, unprecedented news or a flash crash. In both cases, it might make sense to take a little break to catch a breath, absorb all the surrounding information and reassess trading strategies.

The other big reason is the Regulator. Following huge market plunges like the one on Black Monday (October 1987), the regulators came up with circuit breakers to try to cool down the stock market and prevent it from a total collapse.

On the other hand, one of the reasons against the circuit breakers is that the price discovery mechanism is significantly impacted during the halting period and can lead to abnormal trading volume and volatility when trading resumes.

A quick history of circuit breakers

First circuit breakers were introduced after Black Monday in October 1987 when the stock market tanked 23%. The initial market-wide circuit breakers were based on the Dow Jones Industrial Average and not the S&P 500. They were also point-based instead of percentage-based. The first time the circuit breaker like that kicked in was in October 1997 (mini-crash). That was the only time in the history of the NYSE when the Dow Jones Industrial Average based circuit breaker was triggered. After that, the circuit breakers evolved and started using a percentage-based mechanism based on the S&P 500 index.

On the 9th of March 2020, the New York Stock Market halted trading for 15 minutes as a result of triggering level 1 circuit breaker caused by a 7% drop in S&P500 on fears of a global pandemic. 3 days later on the 12th of March, the level 1 circuit breaker was triggered again and stopped trading for another 15 minutes.

In both cases, the circuit breakers worked as designed by calming down the stock market and preventing it from further loses.

Extra

Flash Boys by Michael Lewis (a story about high-frequency trading) ► https://amzn.to/38T2Y0N

If you have any questions about the circuit breakers, please comment down below