So what are NFTs all about? And how can they be used in decentralized finance? You’ll find answers to these questions in this article.

NFTs

Okay, so let’s start with what NFTs actually are.

NFTs stand for non-fungible tokens and they are one of the types of cryptographic tokens that can represent ownership of digitally scarce goods such as pieces of art or collectibles.

“Non-fungible” is not a very popular word so let’s see what it really means.

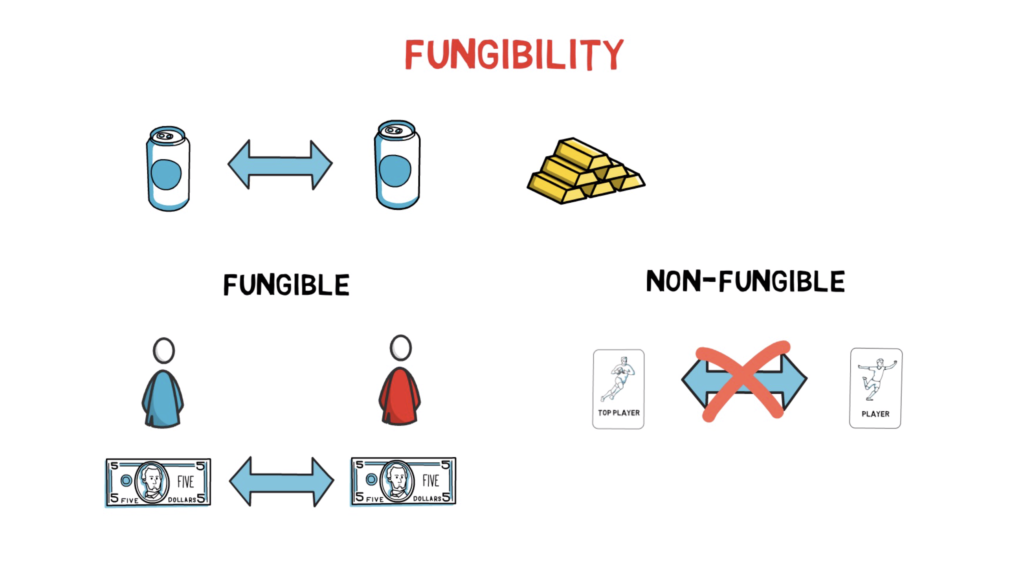

In economics, fungibility is the characteristic of goods or commodities where each individual unit is interchangeable and indistinguishable from each other.

Like with most concepts, fungibility is best explained with an example.

Fiat money such as the US dollar is a good example of something fungible. If Alice has a $5 banknote, she can replace her banknote with Bob’s $5 banknote without this affecting Alice or Bob.

On the other hand, Alice’s favourite, limited edition basketball card is a good example of something non-fungible. Each card is treated as a collectible and has individual properties. A card with one player doesn’t usually have the same value as a card with another player. On top of that, even when considering 2 exactly the same cards, other factors such as the year of production or how the card is preserved can make a difference.

An extreme example of something non-fungible is a piece of art. A painting, for example, is usually created as only one original copy.

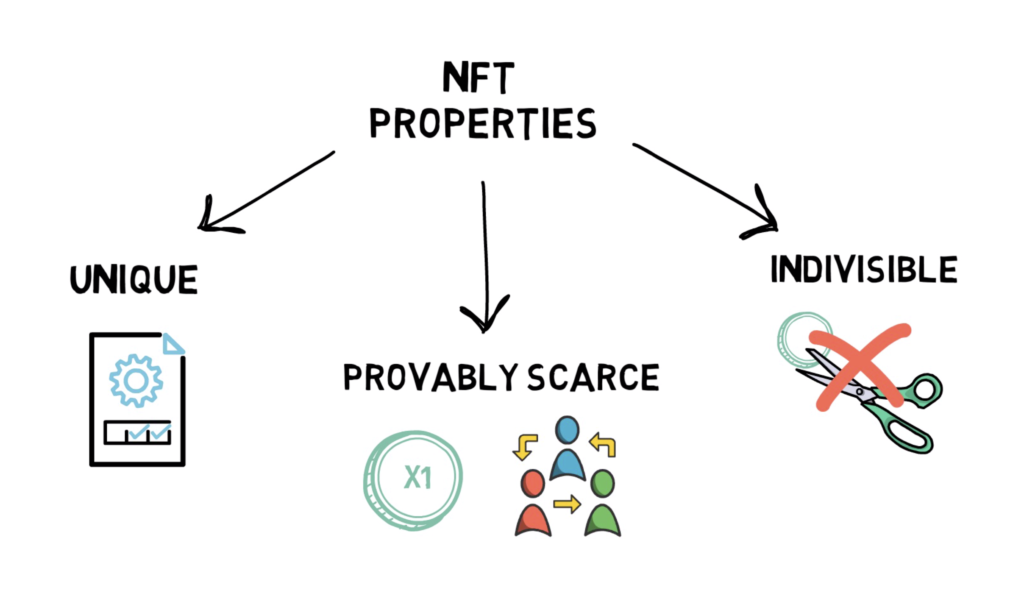

Now, as we know what non-fungible actually means let’s see what the most common properties of NFTs are.

Unique – each NFT has different properties that are usually stored in the token’s metadata.

Provably Scarce – there is usually a limited number of NFTs with an extreme example of having only 1 copy, the number of tokens can be verified on the blockchain, hence it’s provability.

Indivisible – most NFTs cannot be split into smaller denominations, so you cannot buy or transfer a fraction of your NFT.

Similarly to standard tokens, NFTs also guarantee the ownership of the asset, are easily transferable and are fraud-proof.

NFTs on Ethereum – ERC-721 & ERC-1155

Although NFTs can be implemented on any blockchain that supports smart contract programming, the most noticeable examples are ERC-721 and ERC-1155 standards on Ethereum.

Before we get into the NFT standards, let’s quickly recap what ERC-20 is, as it will be useful for comparison.

ERC-20 is a well-known standard for creating tokens on the Ethereum blockchain. Some of the examples are stable coins, such as USDT or DAI and DeFi tokens such as LEND, YFI, SNX and UNI. ERC-20 allows for creating fungible tokens. So all of the tokens that were just mentioned are completely indistinguishable and it doesn’t matter if we receive USDT from our friend or from one of the exchanges – the value of each token is still the same (to simplify this explanation, we’re skipping the possibility of receiving tainted tokens that would actually make a difference between tokens making them “less fungible”).

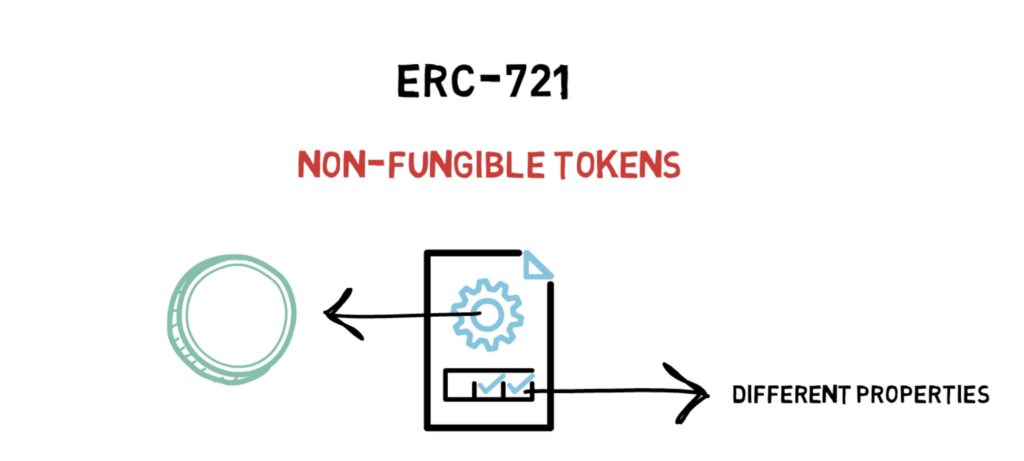

ERC-721 is a common standard for creating non-fungible tokens. ERC-721 allows for creating contracts that can be used to create distinguishable tokens with different properties. A common example of this is the famous CryptoKitties – a game that allows for collecting and breeding virtual kittens.

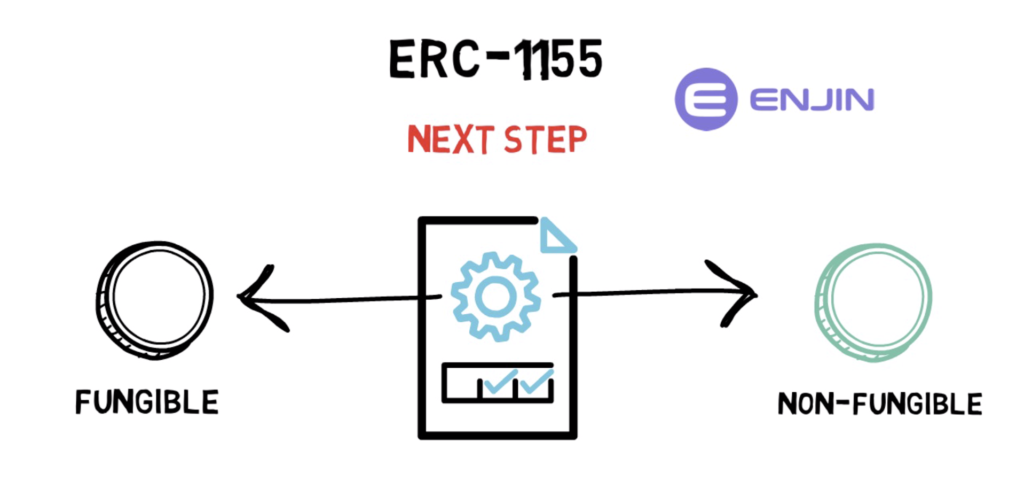

ERC-1155 is the next step in creating non-fungible tokens. The standard allows for creating contracts that support both fungible and non-fungible tokens and it was created by Enjin – a project focusing on blockchain-based gaming. In many games such as World of Warcraft, a player can hold both non-fungible items – swords, shields, armours and fungible items such as gold or arrows. This standard allows developers to define both fungible and non-fungible tokens and decide how many of these tokens should exist.

NFT Space

Besides the already mentioned CryptoKitties, there are a few other fairly popular games leveraging the power of NFTs such as Gods Unchained and Decentraland.

Decentraland is an interesting example as the players are able to buy parcels of digital land that can be later resold or used as advertising space within the game.

Other examples include marketplaces for digital art such as Rarible, SuperRare and even aggregators of marketplaces – OpenSea.

Yet another example of something scarce that can be represented as NFTs, are domain names, for example Ethereum Naming Service with .eth extension, and Unstoppable Domains with .crypto extension.

Some of the NFTs can be extremely costly. The most expensive Crypto Kitty, Dragon, was sold for 600 ETH at the end of 2017, worth around $170k. Scarce domain names such as exchange.eth can be worth upwards of $500k.

NFTs and DeFi

When it comes to DeFi, NFTs can unlock even more potential for decentralized finance. Currently in DeFi, the vast majority of DeFi lending protocols are collateralized. One of the most interesting ideas is to use NFTs as collateral. This means that now you’d be able to supply an NFT representing a piece of art, digital land or even a tokenised real estate, as collateral and borrow money against it.

This sounds cool, but here is the problem. In our standard lending and borrowing DeFi platforms, such as Compound or Aave, the value of supplied collateral can be easily measured by integrating price oracles. These aggregate prices from multiple liquid sources such as centralized and decentralized exchanges. When it comes to NFTs, the markets for particular tokens are very often illiquid which makes the price discovery process tricky.

To understand this problem better, imagine that someone buys a rare CryptoKitty for 10 ETH. This NFT is later used as collateral and the borrower draws 1,750 DAI, assuming that 10 ETH is worth $3,500 and this particular NFT has 50% LTV (loan-to-value). After this, if no one else is willing to buy this particular CryptoKitty, we can say that the market for this NFT is illiquid or even non-existent. The only thing we can assume is that the NFT is still worth the same amount as it was last sold for. This is of course not a safe assumption as the value of NFTs can change quite dramatically.

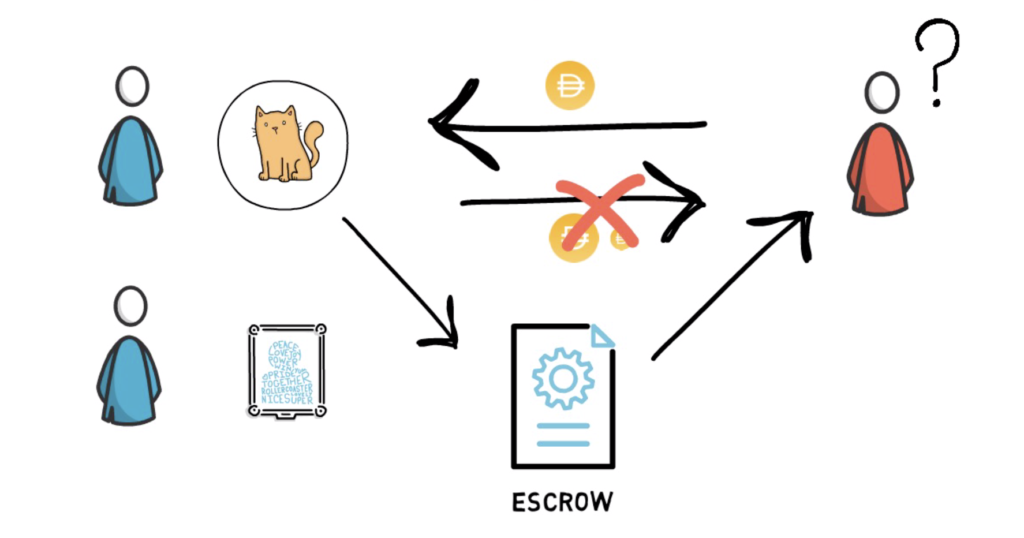

This is also why some of the projects that offer NFT collateralized loans use a slightly different model of peer-to-peer loans. In this marketplace model, borrowers can offer up NFTs as collateral and lenders can choose which NFT they are willing to accept before initializing a loan. The NFT that is used as collateral is kept in an escrow contract and if the borrower defaults on their loan by not repaying the borrowed amount + interest on time, the NFT is transferred to the lender. This space is really new, but one of the companies that use this model is NFTfi.

Besides being used as collateral, NFTs can also represent more complex financial products such as insurance, bonds or options. Yinsure from Yearn Finance is a good example of NFT usage in the insurance space. In Yinsure, each insurance contract is represented as an NFT that can be also traded on a secondary market such as Rarible.

Speaking about Rarible, we have also recently started seeing DeFi-native concepts, such as liquidity mining, being used by the NFT projects. Rarible, for example, started rewarding its users with RARI governance tokens for creating, buying and selling NFTs on their platform.

Summary

With over $100M worth of NFT traded, and $6M just this month, the NFT space is one of the fastest-growing niches in crypto and has huge potential, ranging from digital kittens to complex financial products.

So what do you think about the future potential of NFTs? Do you know any other good examples where NFTs can be used in DeFi?

If you enjoyed reading this article you can also check out Finematics on Youtube and Twitter.

We’re also participating in Gitcoin Round 7 where every, even the smallest, contribution matters. If you’d like to support us, here is the link.